US Consumers Riding to the Rescue Again

The Pacifica Partners Fall 2015 Quarterly Commentary:

There are not many things in finance that one can find a near perfect consensus on. One that comes close to unanimity is the notion that the current regime of low interest rates globally has about run its course in being able to accelerate economic growth. Simply put, low interest rates are yielding diminishing returns and might even be – according to some – making things worse. This is noteworthy because investors started 2015 on a razor’s edge fearing an inevitable interest rate increase from the US. So far, they are still waiting. It is not so much the fear of a single 0.25% increase in US interest rates that has the markets spooked but rather the question of whether or not there are multiple interest rate increases to follow.

Nearly seven years after the end of the last recession, there seems to be a lot of economic head scratching going on. The world today looks nothing like what the economic textbooks say it should look like. Since 2006, there have been over 700 interest rate cuts by central banks around the world and still a strong globally synchronized economy continues to elude policy makers and many are looking around at each other to figure out which one of them has an answer. In our opinion, the best bet to help keep economic growth moving forward is once again the US consumer. US Treasury Secretary Jack Lew said as much at this month’s IMF and World Bank conference in Peru that “Global growth has fallen short…We need to redouble our efforts to boost global demand rather than relying on the United States as the consumer of last resort.”

US Consumer Strength

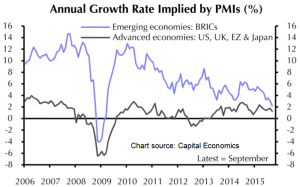

As the largest economy in the world, the US is the engine that drives the global economy forward. Within that engine, the US consumer is the most important cog.US consumer spending accounts for almost 70% of the US economy and is about the same size as China’s entire economy. Many economists had assumed that once the last recession ended, the world would have to depend on the BRIC nations of Brazil, Russia, India and China with their massive populations and high growth rates to drive the global economic recovery. That has not happened as one-by-one the BRICs seem to have stumbled backwards (see chart below).

- Annual Growth Rate Implied by PMIs – Hat tip to: Capital Economics

The underpinning of consumer spending has to come from confidence. After all, if consumers are not confident, they tend to hold back from buying new goods and services and instead choose to increase their savings. For example, as the economy began to slow down in 2007 and 2008, consumers began to spend less and save more. As they began to put away their wallets, the percentage of after-tax income going to savings went from 2% to 8% – and still remains at a national rate of over 4%. While a healthy savings rate helps to ensure that the balance sheet of consumers is able to withstand economic downturns, savings acts as a leakage from the economy. For most of the period since the last recession ended, most US households have been focusing on “repairing their balance sheets” by paying down the substantial debt they had run up in the years leading up to the 2008 recession. Data from TD Economics shows that the US counties that had the greatest increases in household leverage (debt) saw the largest drop in spending – which has held down the US economic recovery during this decade. Demographically, the data shows that prior to the last recession, all income groups except for the top 5% of income earners were not saving at all. Their negative savings rate was made possible by borrowing.

For much of this economic recovery, consumer spending has been halting at best. The two main reasons for this have been that consumer focus has been on paying down the buildup of debt (deleveraging) and the lack of growth in wages (income) for the majority of American consumers. Recent data shows that US consumer expenditure growth is now running at the highest rate of growth in nearly ten years and consumer confidence hit a seven-month high. The greatest source of consumer confidence comes from individuals being comfortable in their future and that typically comes from improving employment circumstances and wage or salary improvements.

Real Estate Firming

The real estate sector is important to consumer spending and the broader US economy for two reasons. One is that the sector has links to so many industries such as furniture, lumber, materials, and finance. Thus, a healthy real estate sector is a key driver of the economy. Secondly, real estate is the most valuable asset many households own, rising house prices will increase the wealth of households – which tends to coincide with rising consumer spending. For this reason, financial markets place great importance on data related to the US housing sector.

Further supporting the outlook for the US economy, the data for pending home sales and existing home sales is showing continued firming. First time home buyers are also showing strong momentum as the credit markets have mostly returned to normal and job growth gathers momentum. Recent data shows that total home sales reached the highest level since before the onset of the last recession. Home resales jumped to a near 8-1/2-year high in July and groundbreaking on new home building climbing to its highest level since October 2007.

Auto Sales

Like real estate, the auto sector is a key component of the US economy. It has often been said that “As goes the auto industry, so goes the nation”. US auto sales are currently running at the fastest pace in a decade and Scotiabank estimates that passenger vehicle sales will exceed 17 million units in 2015. Like real estate, the resurgence in car sales is being fueled by rising employment income and plentiful and cheap credit. In addition, the average age of US vehicles is at a record of 11.5 years and this aged fleet is being replaced. Auto sales are expected to continue to move higher over the next several years as nearly half of the 258 million vehicle fleet in the US is at least 11 years old.

Global Picture Is Mixed

The mixed picture from the international markets has combined to create a sense of anxiety in the financial markets. In Europe, it has taken nearly seven years for a normal set of economic conditions to even come into focus – never mind actually take hold. Aggressive policy responses in the US along with the inherent strength of the US economy’s foundations have allowed US output to rise almost 10% above the peak levels prior to the last recession whereas in Europe it is still about 1% below the pre-recession peak. The response to the US economic stimulus was highly criticized at home and abroad as it was feared it would drive inflation and cause irreparable harm to the US dollar. Germany’s Finance Minister went so far as to refer to the US central bank’s policy of aggressive stimulation as being nothing more than “clueless”. Two years later, Europe’s central bank decided to steal a few pages from the US playbook and chart a similar course of action. At the time, the US unemployment rate was 9.4% (5% today) and in Europe it was 10.2% (10.9% today).

As was mentioned previously, consumer confidence starts with employment and income prospects and these data points are starting to turn around and head in an encouraging direction. Recent data shows that bank credit is once again flowing in Europe, consumers are beginning to spend again and unemployment rates are stabilized – though still stubbornly high. Across Europe, wages and salaries are improving at the fastest pace since 2008.

One of the most encouraging pieces of data comes from the auto sector in Europe as car sales in Western Europe have sped up to an 8% yoy increase for the first half of 2015 and will hit a 5 year high of about 13 million units. As is the case in the US, this is coming from a rebound in consumer confidence.

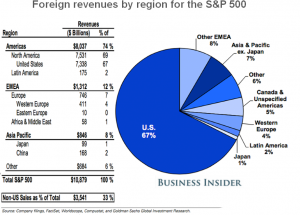

S&P 500 Foreign Revenues by Region: Hat tip to: Business Insider

China’s Auto Sector

Along with the US ($19 trillion) and Europe ($17 trillion), China’s ’s $11 trillion economy has a huge impact on the global economy. China is in the process of dealing with many structural reforms to its economy that will in all likelihood hold back economic growth. It is trying to make the painful but necessary adjustments that will promote its long term well-being. These include allowing uncompetitive state-owned enterprises (SOEs) to either adapt or die to the challenges of the global economy; promote a more entrepreneurial zeal amongst its business community; allow for banking reforms that will cut off credit from being directed to enterprises and developments that are built or started based on corrupt political and business practices – rather than on whether or not it makes good business sense. This is just a partial list. The trade off will be that China will see a slower rate of economic growth and will therefore be importing less commodities and other goods.

Staying with the theme of autos, China’s auto industry provides a good example of the adjustments and reforms that are needed in China. With the slowing economy, Chinese auto demand has fallen. In fact, car sales are down three months in a row – contrasting to the US and European experience in the auto industry. The last time that sales fell three months in a row was during the last recession. The trouble is that as is so often the case with Chinese economic data, the devil is in the details. The demand figures include wholesale shipments from car markets to car dealers whereas in North America, only sold cars are counted. When we look at the sales data of US car makers in China such as Ford and GM, it is clear things are not well there with western estimates showing that China’s nearly 20,000 auto dealers have almost two months of sales in inventory – which is above the red-alert level according to industry sources. Yet production continues. In North America, the supply response would have been much more rapid.

As is the case in North America, Chinese consumers make decisions in part based on their confidence in their own personal economic future. The slowing economy and drastic drop in the Chinese stock market has left a welt to be sure. The economy in China is creaking under the weight of too much debt that was invested unwisely in poorly thought out projects and real estate that was adding to a supply glut of homes. As we have highlighted in previous years, China’s giant debt load was made worse by the government’s response to the 2008 recession. In an effort to get the economy moving again, local governments were given the approval (mandate) to borrow huge sums as part of its $570 billion economic stimulus package that was supposed to jumpstart the economy. At the time, we noted that the Chinese response made the US government’s response seem positively meek.

As China comes to grips with the fact that much of this money went to expand industries already straining under excess capacity and a real estate market that was already vastly oversupplied, the government really has nothing to build – that is needed anyway. The end result has been many local governments that are broke or nearly broke and that has forced the central government to swap local government debt for that of the central government. As part of its necessary but painful reform program, the Chinese government has put a cap on just how much of this debt it will take on. This is reflective of its goals of allowing some painful adjustments to take place for the long term benefit of the Chinese economy.

Looking Forward

It is clear from the previous pages’ discussion that economic growth is still uneven. In past commentaries, we have touched on some of the reasons for this. That being said, there is much to be optimistic about. On balance, Europe and North America have undergone a long adjustment period since the end of the last recession. Now it is China’s turn.

From our perspective, the data shows that on the whole, US and Canadian companies have very little direct exposure to the Chinese economy. The technology sector has the most revenue exposure to China followed by the materials sector as China is still the largest consumer of most raw materials and commodities.

As the nation with the second largest economy in the world, China’s successes and failures most certainly have an impact on the world economy. We believe that the Chinese leadership will continue on its road to reform but its path will be gradual. It has always demonstrated a willingness to take the long road to achieve its goals. We think markets would be both reassured and welcoming of that approach.

The US economy continues to show steady progress. The number of unfilled job openings is at record levels and this indicates to us that companies are not retrenching. While the economic indicators are holding fast, investor anxiety has been ratcheted up. Globally, the equity markets have come some ways to adjusting their expectations of the level of economic growth that can be reasonably expected. The correction we have seen in the markets has been underway since mid 2015 and is helping to make equities reasonably priced once again.

![]()