The Strong Economy-Rate Cut Paradox

In this issue

- Markets demanding an interest rate cut as insurance to ward off effects of a slowing global economy

- Federal Reserve feeling pressure to act from both financial markets and Trump

- Slowdown in corporate earnings being offset by rising valuations (PE multiples)

One of the best words to describe the current state of affairs in the markets is paradox. The paradox comes from the fact that US equity prices are near all-time highs, unemployment levels are near all time lows and consumers are in an exuberant mood. However, all of this good news is being shunted aside by the financial markets’ demand that the US Federal Reserve cut interest rates to help shield the economy from the effects of slowing economic momentum around the world. China’s economy is growing at the slowest rate in the last 30 years while Europe has is muddling along with about a 1% economic growth rate. As bond markets have priced in at least three interest rate cuts for the balance of 2019, equity markets are rising in anticipation. The consensus in the markets is that the US Federal Reserve will bend to the demands of investors and begin to deliver interest rate cuts this summer. The Federal Reserve is well aware that markets would not react well if hopes of a rate cut are dashed.

The demand for an interest rate cut is also being sought out by President Trump. While no president wants to see interest rates rise this close to an election, Trump has likely crossed a line that up until now had not been crossed. This is because he has been explicit and very public in demanding interest rate cuts. His repeated assertions that the Fed does not know what it is doing or that it made a mistake in raising interest rates has likely made the Fed more sensitive to not being seen as caving in to Trump’s demands because it would call into question its independence. For his part, US Federal Reserve Chairman, Jerome Powell, stated that the law creating the US Federal Reserve preserving its independence was aimed at avoiding “the damage that often arises when policy bends to short-term political interests.” An independent monetary authority is a key component of the US economic system. According to David Wessel, a monetary policy expert at the Brookings Institution, “The President of the United States is not usually adding to the confusion as he is now. The President has made everything harder.”

Fear of Importing A Slowdown

It is often said that the US does not import economic problems from abroad but it can export its own. This is because the US economy is less dependent upon trade for economic growth as compared to Asia and Europe. But the fear amongst President Trump and the markets is that the global slowdown will begin to impact the US and therefore the economy needs an “insurance cut” in interest rates.

A Tale of Two Economies

Early into second quarter earnings announcements, it seems that there are two separate US economies—the consumer economy (as measured by banking, restaurants, retail sales etc.) and the industrial economy (railroads, manufacturing companies etc.). According to Jim Foote, CEO of railway company CSX Corp., the volume of railway shipments on its rail network has been falling. Foote made headlines in a call with analysts when he said “Both global and U.S. economic conditions had been unusual this year, to say the least, and have impacted our volumes. You see it every week in our reported carloads. The present economic backdrop is one of the most puzzling I have experienced in my career.”

In contrast to Foote, Jamie Dimon, of banking giant JP Morgan commented that “It’s not that bad. You know, uncertainty is a constant … but what I think we see is global growth is north of 3%, you kind of expect the United States to be 2.5% this year. The consumer in the United States is doing fine, business sentiment is a little bit worse … so I wouldn’t get too pessimistic yet.”

Fed Giving Mixed Messages

In recent weeks, other members of the Federal Reserve’s policy making board have changed their opinion from being against rate cuts and some have been quite explicit in advocating for a rate cut. The President of the New York Fed, John Williams, stated in a July 18th speech that “When you have only so much stimulus at your disposal, it pays to act quickly to lower rates at the first sign of economic distress.” Williams’ voice is especially important because he is an authority on “zero lower bound” interest rates (i.e. when short-term interest rates are approaching zero and cannot go much lower). Whereas some countries have experimented with negative interest rates, the policy is largely a failure since negative interest rates will induce households to horde cash outside of the banking system—removing cash that would act as a source of fuel for the credit system. Negative interest rates also force some households to increase their savings since the amount of interest income that they earn is impaired. It should be noted that following Williams’ speech the bond markets increased the chance of a 0.50% cut in interest rates to 50% from 34%.

No sooner had markets taken Williams’ statement as a credible hint on upcoming interest rate cuts, things took a surprising turn. The very same evening, the Federal Reserve made an unusual move by issuing an urgent clarification in which Williams stated that he was only summarizing the findings of academic research and as far as his actual policy vote goes—he was not leaning one way or the other. As would be expected, President Trump jumped on Williams’ retraction as the above tweet shows.

To further reassure the markets, US Federal Reserve Vice Chairman, Richard Clarida, echoed Williams’ comments that an “insurance cut” in interest rates at the first sign of potential economic trouble was good policy and part of the toolkit. Clarida further stated that “The global data has been disappointing on the downside, disinflationary pressures are more intense than I thought six weeks ago. Under ideal monetary policy, you adjust rates to keep the economy on an even keel and so you don’t necessarily want to wait… until the data turns decisively, if you can afford to.”

Mixed Data

On the whole, US economic data has been mixed with some datapoints coming in stronger than expected and some clearly showing a loss of economic momentum. The last time the US Federal Reserve cut interest rates at a time that equity markets were near record levels was in 1996. In its history, it has cut rates with stocks at near-record levels a total of seven times. If the Federal Reserve does as expected we will see an eighth time. But this will be the first time it has done so with the unemployment rate below 4% (currently 3.6%).

An Economic Cycle For the Record Books

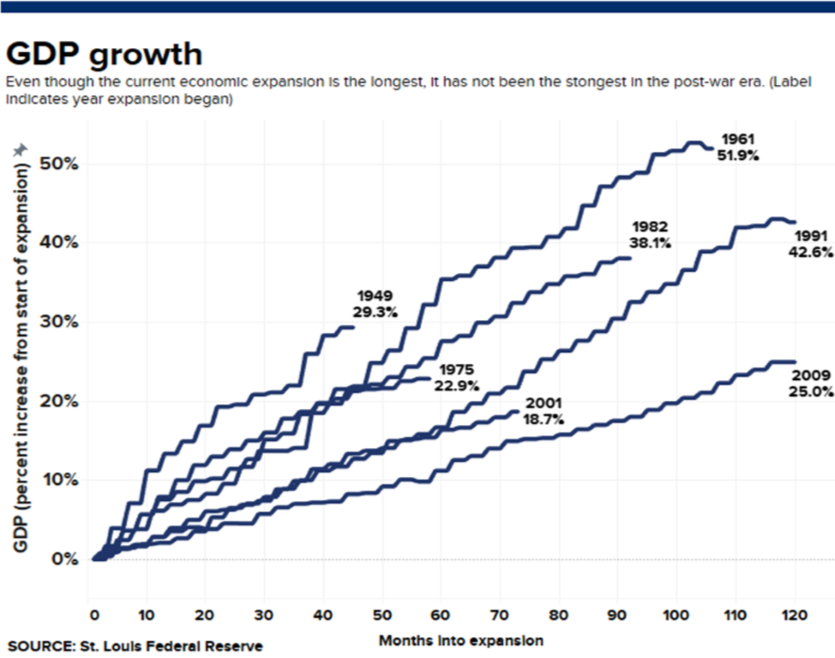

The present US economic expansion cycle is now the longest in history as it has entered its 121st consecutive month for growth. The prior record was the expansion from 1991-2001 of 120 months. However, the current expansion has delivered far lower economic growth owing to the below-average rate of growth this cycle. As the chart above shows, the economic cycle has been a little on the weak side compared to historical standards. US GDP has only increased by 25% over its record length whereas the second longest expansion produced 42.6% of GDP growth. Despite this, the US still leads Europe, Japan and Canada in terms of economic expansion since the end of the last recession.

Markets Might Be Expecting Too Much

While markets are often forward looking, a reasonable question to ponder is whether or not markets are expecting too much economic magic from a reduction in interest rates. Some economists even question the efficacy of monetary policy once rates are at or near the zero-bound. Some researchers have written academic papers that concluded that jawboning and policy announcements had a greater impact than most central bank policy measures. Thus, credibility is an important tool and further enhances the reasons for why the White House or any government should stay out of monetary policy decisions.

Earnings Could Overshadow Interest Rates

As intense as the focus on interest rate policy has been, it could be overshadowed by corporate earnings announcements in the upcoming weeks. As second quarter corporate earnings announcements are released, markets will be focused on what the outlook is from corporate executives and how the slowdown in economic momentum is impacting their sales, profits and expectations for further investment in their operations. At this point, consensus forecasts are calling for quarterly earnings to be lackluster. It is one reason that the US equity market as measured by the S&P 500 market index has swung inside a rather wide range since 2018—while setting a record high. This is not the first time that during this economic cycle that earnings growth has become tepid at best. For an 18 month period ending June 2016, corporate earnings growth was largely negative (an earnings recession).

While 2018 saw a 23% rise in year over year earnings, the current consensus is calling for only 2.4% in profit growth for 2019. According to market data provider FactSet, 113 companies have issued guidance on earnings and 77% of them have announced earnings guidance below Wall Street analyst estimates. This is the second-worst level since FactSet started tracking this data in 2006! But markets are aware that 2018 earnings saw a one-time boost from the Trump tax cut which boosted corporate earnings by about 7-8%.

What has allowed the markets to look past falling earnings estimates is the prospect of lower interest rates. In general, lower interest rates allow for an inflating of stock market valuations—even in the face of slowing profit growth. However, any negative surprises to the market’s already discounted level of earnings could lead to a return of increased volatility.

Fed Trying to Pull-off a Balancing Act

Though Powell is being pressured from within the Federal Reserve and externally from the White House and the financial markets, he has tried to maintain a balancing act by reiterating that he wanted to ensure that developments and trends are “genuine.” Powell has to be careful that he does not misread the signals and the economic data. A cut in interest rates today could lead to an overheated, inflation-laced economy tomorrow. For example, if trade tensions ease between China and the US and the European Union decides to follow through on its stated aims of stimulating the European economy, will an “insurance cut” have been a mistake that has to be taken away sooner rather than later? Using the data to forecast the economy is a difficult undertaking at the best of times. Current circumstances are making forecasting an even more delicate art than usual.