Tariffs, Trade & Turmoil 2.0

In This Issue:

- Artificial Intelligence’s rise is not without challenges

- AI showing great promise for the global economy

- Murky math of US tariff levies is puzzling

- China is the center of US tariff policy but there is some room for budding opti-

Since the 1980s, mainstream thinking had come to a consensus agreement amongst economists, business leaders, and policy makers that more trade amongst nations was a win-win policy. To facilitate this, free trade was seen as the way forward. Tariffs and trade barriers were to be chipped away to usher in more economic growth, higher employment, and lower prices.

At the time of its signing in 1987, the Canada – US Free Trade Agreement (CUSFTA) was the most significant free trade agreement in the world. However, in Canada, it was not a fait accompli as many Canadians saw free trade with the US as risky. Opponents believed that given the fact that Canada’s economy and population are one-tenth that of the US, it would lead to Canada losing its sovereignty, its public health care, and more.

In 1988, the ruling Conservative Party ran for re-election on the merits of free trade and won by convincing voters of the importance of signing the CUSFTA with the United States. The CUSFTA was followed up with the 1992 signing of the North American Free Trade Agreement (NAFTA) which brought about a free trade arrangement between Canada, the US, and Mexico. This time, it was the US that saw the most opposition to free trade – primarily due to fears that lower wages and environmental standards in Mexico would cost the US manufacturing jobs. One of the most memorable quotes opposing NAFTA belonged to former presidential candidate Ross Perot when he stated in a 1992 Presidential Debate, “We have got to stop sending jobs overseas. It’s pretty simple: If you’re paying $12, $13, $14 an hour for factory workers and you can … pay a dollar an hour for labor … there will be a giant sucking sound going south.”

President Trump has made similar arguments as Ross Perot and championed policies aimed at bringing more manufacturing jobs and more factories to the US. Long before entering politics, he has expressed his belief that the US has been getting taken advantage of by foreign nations and the trade deals that have been made by the US in the past have cost the US factory jobs. In the 2016 campaign, Trump stated “Bringing back our manufacturing jobs is the key to restoring the middle class” and in 2020, he stated “We want companies to build their factories in America, not overseas. We’re working on trade deals that put American workers first.”

Trump Trade Policies Wake Up Canada

Canada has long enjoyed the benefits of being situated next to the United States. Sharing a border with a nation that has the largest economy and most powerful military has certainly been helpful to its development. At the same time, Canada has maintained a sense of both gratefulness and occasional unease since its founding. During his 1969 trip to meet President Nixon, Canadian Prime Minister Pierre Trudeau spoke to the National Press Club in Washington, DC. Trudeau told the audience “Living next to you is in some ways like sleeping with an elephant. No matter how friendly and even-tempered is the beast, if I can call it that, one is affected by every twitch and grunt.” The audience roared with laughter. Today, the calls by President Trump for Canada to become the 51st state are rekindling Canadian emotions ranging from anxiety to anger.

The trade dispute with the US comes at a time that Canadians are realizing they have experienced a lost decade in terms of the economy. As we have highlighted in past commentaries, Canada’s per capita income growth has been about flat over the last decade and is amongst the worst in the G20 group of nations.

On paper, Canada has everything the world needs – energy, agricultural products, lumber, minerals, and manufacturing capability. Somehow, it has not translated into income growth. Seeing the writing on the electoral wall, Justin Trudeau resigned as prime minister as his poll numbers sank due to a population angered over the economy, taxes, cost of living, and crime. As the US – Canada relationship hit perhaps its roughest patch in over a hundred years, Trudeau was likely reminded of what his father told the National Press Club.

Canada, Mexico and China

Despite the signing and then re-negotiation of the USMCA by the Trump Administration in 2020, Trump has recently singled out Canada and Mexico as taking advantage of the US because both nations had a trade surplus with the US. He has stated that Canada is putting up non-tariff barriers to US exports and Mexico is being used by China to funnel into the US goods made in China made by using the cover of the USMCA.

Often missing in the headlines is that the North American tariff dispute began with the US making the case that narcotics, such as fentanyl, were being smuggled in through the open border with Mexico and Canada. The US government has stated that given the fentanyl epidemic in many parts of the US, there is a national emergency under the International Emergency Economic Powers Act (IEEPA) of 1977. Under the US Constitution, only Congress has the authority to impose taxes and tariffs, but Congress gave presidents the power to use the IEEPA to impose tariffs without Congressional approval if a foreign threat emerged.

About 2% of the fentanyl intercepted at the US border has been along the Canadian border and the rest has been at the US border with Mexico. US Customs and Border Protection (CBP) data shows that from 2019 to 2024, 80% of individuals caught with fentanyl at border crossings are American citizens. While the amount found by authorities at the US-Canada border might be small, it is enough to harm at least several hundred thousand people with some estimates ranging far higher.

Autos Are The Center of the Storm

Canada and Mexico each have a nearly US $750 billion annual trading relationship with the US that reflects the deep economic integration amongst the nations. Canada is the largest export market for US goods and 34 states sell more goods to Canada than any other foreign economy. In addition, trade between the US and Canada is highly integrated with most Canadian exports to the US serving as inputs for US companies’ production processes. For this reason, tariffs on Canadian goods are likely to raise US industry’s production costs more than the cost increases arising from tariffs being applied to imports from other nations.

This is likely going to be mostly felt in the auto sector which accounts for 22% of total trade between the three nations. For Canada, auto manufacturing accounts for 128,000 direct jobs. According to 2020 data cited by the Canadian Vehicle Manufacturers’ Association, for every one auto assembly job, approximately ten other jobs are created in Canada. The supply chain of the auto industry shows how complex applying a tariff really is since it become quite difficult to apply a tariff on a non-US car part. Depending on the model and the particular auto part, a single component or subcomponent can cross a border in North America six to eight times.

Madagascar Math

One of the ways in which the Trump Administration has categorized nations for the kind of tariff treatment they will get is whether or not a particular nation runs a trade surplus or deficit with the US. Once again, the critics of this approach have a point when they see a nation such as Madagascar- which runs a USD $560 million trade surplus with the US – being given a 48 percent tariff on its exports to the US but Australia on account of its $18 billion trade deficit with the US receiving a 10 percent tariff on its exports to the US. It should be noted that Madagascar’s exports of $670 million are dominated by vanilla beans and apparel – two things the US cannot produce cheaply or easily. In turn, Madagascar does not have the earnings power to make meaningful purchases of US exports such as autos or military equipment. Looking at Madagascar provides an example of where the Trump Administration’s tariff math is seen as puzzling.

In another example of “murky math”, trade experts and policy makers in the US and Canada have expressed some puzzlement at President Trump’s claim that the US is subsidizing Canada in the amount of USD $200 billion. It seems nobody – including from the president’s own team – has clarified where that figure comes from exactly. If one were to hazard a guess, then perhaps the president is taking the roughly $63 billion trade deficit with Canada and adding Canada’s well-known shortfall in its defense spending commitments as a member of NATO. This figure then is added up over the last four years. To be fair, Canada is woefully short on defense spending and has also been called out by European allies and by the Biden Administration for not contributing what it is obligated to under NATO. Canada is seen by many nations as benefitting from the US and NATO umbrella without being a fair contributor.

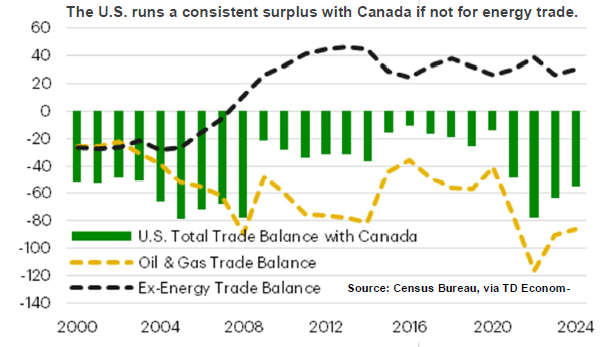

Clearing The Air: Canada’s Trade “Surplus”

Canada ran a trade deficit with the US of about USD $45 billion if energy (oil, gas, and electricity) is excluded. Once Canadian energy exports to the US of about USD $108 billion are added back, the data shows that Canada had a trade surplus of about $63 billion in 2024. If the US was not in need of Canadian energy, the US would enjoy a substantial surplus. As things stand, Canada provides 4 million barrels of crude oil per day to the US – amounting to about 25 percent of the crude oil used daily in the US. Furthermore, due to factors related to its physical properties and transportation costs – Canadian oil is sold to the US at prices ranging from $13 to $18 per barrel below market prices. This helps the US because it can export its own oil at much higher world prices which boosts its economy.

Beyond energy, 85% of all of the potash used by US farmers as a fertilizer input is imported from Canada. Clearly, the president is wrong when he says that Canada does not have anything that the US needs. In recognition of this, the Trump Administration has backed off and exempted Canadian energy from tariffs. This was to be expected because a tariff on Canadian oil would have raised gasoline prices by $0.30 – $0.70 per gallon – something US consumers (voters) would have noticed quickly.

Often forgotten in the energy discussion are Canadian electricity exports to the US. Ontario supplies electricity to about 1.5 million US homes in Michigan, Minnesota and New York while Quebec supplies about 2 million households in the eastern US.

All Roads Lead to China

Behind some of the economic reasons for wanting to bring down the US trade deficit is the desire of the Trump Administration to become self-reliant for core goods such as steel, aluminum, semiconductors, and pharmaceuticals. With respect to pharmaceuticals, China controls the global supply of the precursor chemicals that give finished product pharmaceuticals their efficacy. Even most of the North American aspirin supply comes from China. It also dominates the US supply chain for its supply of vitamins, antibiotics, and other medicines. In his book “Fear: Trump in the White House”, author Bob Woodward quoted Gary Cohn, the chief economic advisor to President Trump in his first term, as advising the president against a trade war with China since it supplied 97 percent of all antibiotics in the US. Cohn counseled “If you’re the Chinese and you want to really just destroy us, just stop sending us antibiotics.” Cohn’s concerns were validated when some media sources quoted an economic advisor to China’s central bank suggesting that China should use its leverage over the vitamin and antibiotics supply chain to restrict the supply of those items in the US.

The Trump Administration will be announcing measures to repatriate pharmaceutical production back to the US. Apart from national security reasons, decentralizing production of pharmaceuticals, and antibiotics reduces the risk to the world since a centralization of the supply chain in China risks vulnerability to a nation – whether it is from accidental or intentional causes.

Glints of Optimism

While financial markets would prefer the tariff fights to never have begun, investors are largely trying to factor into asset prices what the impact of a disruption to trade will be on the global economy. Corporations have largely surrendered to the uncertainty and many are not giving any sort of guidance to what profits might look like over the next year.

We have been here before when the pandemic and shutdown of the global economy clouded the ability of corporations to provide guidance for future profitability. However, it did not stop stock markets from sending the US S&P 500 stock market index up by 63% (measured from the lows of March 2020 to the unveiling of the vaccines). What they are having some issue with is the dizzying array of announcements, reversals, and increases on tariffs coming from the White House.

With respect to China, it is likely that we have reached peak tariff as the US and China have announced tariffs of over 100 percent on certain goods—increasing them further will not have anymore impact on each nation.

Markets are looking for negotiations to yield trade agreements. The US has stated that currently, over 75 nations have asked for talks with the US. Japan and Italy (on behalf of the EU) have already begun talks and President Trump has shown some appreciation of this—which is helpful for financial markets. He has stated that his intention is to get a good deal for the United States but he is not interested in harming the economies of nations that want a deal. He has reiterated that he wants a “fair deal”. That is a helpful statement because it gives some potential visibility to the offramp from trade and tariff disputes.

US trade negotiations are being led by Treasury Secretary Scott Bessent. While Bessent has stated that he would like to reach trade deals with other nations to form an alliance to gain some leverage in talks with China, he has also stated that there is no reason for the economies of China and the US to decouple. He has stated that “There’s a big deal to be done at some point.” President Trump has stated “We’ll see what happens with China. We would love to be able to work a deal.”

These are all positive first steps. But as we noted, while the US is looking to do trade deals with dozens of nations—it is the China relationship that will take the most effort. China is digging in but has stated that if the US approaches it in a respectful manner, it is willing to talk. At this point, there are more reasons to be optimistic than a month ago but it is going to be a long and bumpy ride.