Taking Stock of the Economy’s Recovery

In this issue:

- Measuring the economic rebound

- Fears of a second wave

- Global efforts underway for a COVID-19 vaccine

- Global governments continue to support their economies with stimulus

Any economic downturn is a challenge even under the most normal of circumstances. But throw a global pandemic into the mix and the magnitude of the challenge is amplified considerably. As governments around the world look to implement policies to not only safeguard their populations but also figure out how to reopen their economies, the debate and policy responses amongst the medical professionals, politicians and economists is being watched closely by the financial markets.

By late April and early May, economic indicators began to show that North America and most of Europe and Asia had largely begun to contain the COVID-19 outbreak. In turn, it was hoped that this would lead to the reopening of the economy to mark the first steps back to the “old normal.” However, that path has been made more difficult because of the rebound in COVID-19 cases in the US and in other major economies. Clearly, the final weeks of summer will have a big determination of whether the world has turned the corner on containing COVID-19 and the extent of its impact on the global economy.

Fears of a Second Wave

The economic data continues to show that the 2020 recession will have lasted for only two months and the economy is making its way back to a growth path. The downturn was the shortest on record for the US economy. For comparison, the downturn in 1918-19 was seven months – reflecting the end of WWI and the outbreak of the Spanish flu.

No sooner had the light at the end of the tunnel began to emerge in North America, Europe and parts of Asia that worries about a “second wave” of COVID-19 began to make headlines. The consensus seemed to be that there would be a lull in cases and a pickup towards the Fall months. However, in the US, it seems that the pickup in COVID-19 cases has begun much sooner in some states.

While medical opinions vary, many are pinning their hopes for a way out of the crisis on the greater use of masks and the development of a vaccine. While the development of a vaccine would be a game changer, there are scientific and logistical challenges to overcome even if a vaccine were to be approved. As the former director of the US Center for Disease Control (CDC), Julie Gerberding, noted in one interview “I think the science is on our side. That doesn’t say anything about the speed, the safety and the durability and all of the other criteria that have to come into play before we have something that we can count on to give us that population immunity.”

The Race For a Vaccine

Scientists across the world are working on potential treatments and vaccines for COVID-19. Some scientists at pharmaceutical companies and research labs are working on antiviral drugs to treat people who have COVID-19 while others are focusing their efforts on vaccines to prevent against the disease.

Thus far, the medical weapons in use against COVID-19 are largely drugs that are already approved for other conditions or have been used against the disease. But there are about 135 vaccines that are in the preclinical (not yet in human trials) phase; another 15 vaccines in phase I (testing safety and dosage); a further 11 vaccines in phase II (expanded safety trials); 4 in phase III (large-scale efficacy tests) and 1 vaccine approved for limited use. Historically, it has taken years of scientific research and testing to come up with a working vaccine but there is an incredible global effort to have a safe and effective vaccine in place for early 2021.

The effort to develop a vaccine is global with many nations pouring resources into the endeavour. For the US, its Operation Warp Speed program was launched as a public-private partnership to facilitate and accelerate the development, manufacturing and distribution of COVID-19 vaccines, therapeutics and diagnostics. It should be noted that Operation Warp Speed is not only working with US companies but also the efforts undertaken by the UK’s University of Oxford-AstraZeneca efforts.

Measuring the Economic Recovery

Clearly, the economic recovery from the steepest but briefest recession in history has begun. Millions of workers have returned to their workplaces, consumer spending has begun to rise while construction and manufacturing data has begun to show a rebound. But this must be balanced with an often justified reluctance from consumers to venture out as they did pre-COVID-19. As we noted in last quarter’s commentary, the recovery would be on an uneven path. Even with the return of positive economic momentum, the US Congressional Budget Office (CBO) expects the US economy to decline by an annual rate of 36% in Q2 2020. Factoring in a resumption of economic gr over the next six months, the CBO expects the US economy to shrink by 5% in 2020.

As much of the global economy has gone from lockdown to a phased reopening, the hopes for an accelerated reopening have faded. During a recent media event, Dr. Anthony Fauci, the Director of the US National Institute of Allergy and Infectious Diseases, said that “Rather than think in terms of reverting back down to a complete shutdown, I would think we need to get the states pausing in their opening process looking at what did not work well and try to mitigate that . . . I don’t think we need to go back to an extreme of shutting down.”

The Debt Hurdle

One of the reasons that governments around the world have had to take on trillions in new debt is to help households and businesses stay solvent during the pandemic lockdown. The worry was that the abrupt halt to the economy would lead to a wave of bankruptcies and cause a second Great Depression.

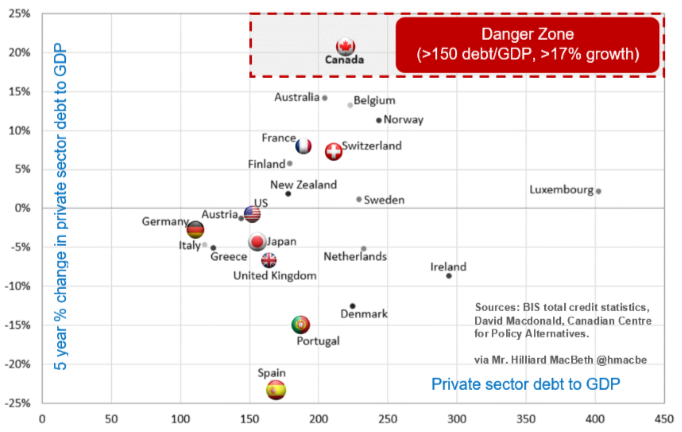

The figure above shows the level of private sector debt relative to the size of the economy for many of the G-7 nations and Western Europe. The data shows that most of these countries have been carrying a large private sector debt burden that has been accelerating in size even before the pandemic hit.

Canada stands out above the other leading economies as its private sector debt level is about 220% larger than its economy but has also been rising at the fastest rate. Clearly, Canadian businesses and households do not have much room to take on more debt to see them through the COVID-19 downturn. For that reason, the Canadian government (like many others) has stepped in to shore up Canadian businesses and households.

The two most important economies on the chart on page 2 are Germany and the US. Germany has stepped up and led the world in terms of the fiscal stimulus it has injected into its economy. Like its private sector, the German government has a strong balance sheet due to its low debt levels relative to the size of its economy.

The US has also been hard at work in getting stimulus into its economy. All sides of the political divide have shown a willingness to get stimulus programs enacted to help households and businesses weather the COVID-19 downturn. At this time, the US Treasury Department is laying the groundwork for another round of fiscal stimulus that will be worth at least $1 trillion.

Stimulus Shaping the Recovery

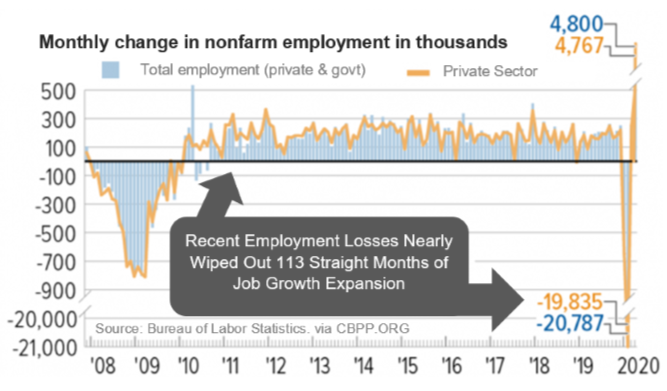

After a sharp rebound from an even sharper downturn earlier this year, the economic recovery will likely lose some momentum. As the chart below shows, US employment—much like the financial markets—saw the fastest and steepest decline in history. However, there has been a sharp upward turn in employment gains since the phased reopening of the US economy.

From here, it is reasonable to expect that the economy will take a stutter-step path to recovery. The reason for this path is that some industries and sectors of the economy are more directly impacted by changes in consumer behavior and are also seen to be riskier to individual health. Thus, they will have a more gradual return to normal.

Offsetting these hurdles is an unprecedented global wave of fiscal and monetary stimulus to help support households and businesses. These measures have resulted in tax cuts, low interest rates and the mailing of cheques amounting to trillions of dollars to households and individuals. As Jamie Dimon, CEO of US bank JP Morgan, noted in his company’s second quarter earnings announcement, “In a normal recession unemployment goes up, delinquencies go up, charge-offs go up, home prices go down; none of that’s true here…Savings are up, incomes are up, home prices are up. So you will see the effect of this recession; you’re just not going to see it right away because of all the stimulus.”

Envisioning a Post-COVID-19 Economy

At the beginning of the pandemic, few understood how long it would be before life returned to normal and some analysts were leaning towards a sharp V-shaped economic recovery. Many analysts now believe that, barring major improvements in COVID-19 treatment (which would make the disease less dangerous), only a vaccine can allow economic activity to return to the pre-pandemic baseline.

As we noted, there are considerable efforts underway towards the development, manufacturing and distribution of a vaccine. At the same time, a restart to the economy will see some starts and stops. Measures will likely be put in place that curtail economic activity to some degree—travel will take time to comeback to pre-lockdown levels, businesses will have to space workers and customers further apart, restaurants will be serving fewer customers at a time and sporting events, concerts and other activities involving large crowds will likely be curtailed for quite some time to come. Even if the rules allow, many people may be reluctant to return to life as it was before the pandemic.

One of the big questions on the minds of economists pertains to how long it will take to get back all of the global economy’s decline and the jobs lost since the onset of the COVID-19 pandemic. Clearly, the 2020 recession will be the worst economic downturn since WWII. Perhaps surprisingly, some economists believe that this recession will not take as long to recover from as the last recession. It is likely that this stimulus will be the only reason that the current recession will not have as much staying power as the Great Recession but it will be a close second. It is worth recalling that the 2008 recession (the Great Recession) exhibited the longest recovery period in the post-WWII period. It took two years for GDP to recover completely and 51 months to get back all of the jobs lost – which is more than twice as long as previous economic downturns. It is possible that with the stimulus delivered (with more to come), this might enable a faster recovery than expected. But science will play a key part in making that happen.