Mr. Xi Goes to Washington

One would have to go back a long way to remember when China’s place in the world was even up for debate. As Chinese President Xi Jinping came to the US for his first state visit last week and second visit as President of China, many are looking at China through a slightly different lens in light of doubts about China’s economy. Chinese leaders have been reassuring the markets that it will not back down in its efforts to stamp out corruption (some at the highest levels of government) and its efforts at trying to rebalance its economy by relying less on exports and construction (real estate) to one that is based more on consumer spending.

The newfound worries about China are coming from the fact that the magnitude of its economic problems is coming into focus. For the first time, China’s challenges are overshadowing its vast successes and accomplishments which include removing tens of millions of its citizens out of poverty; growing its economy into the second largest in the world and being seen as the only country that could challenge the US’s role as the world’s only superpower. As Singapore’s late leader, Lee Kuan Yew noted in 2013, “…the size of China’s displacement of the world balance is such that the world must find a new balance. It is not possible to pretend that this is just another big player. This is the biggest player in the history of the world”.

One of the most surprising statistics about China’s economy relates to debt. Various estimates show that China’s bank loans to the domestic economy have gone from $1 trillion in 2001 to $30 trillion this year while its economy (GDP) has gone from about $1 trillion in 2001 to $11 trillion. Clearly debt has been a substantial fuel. More troubling is that the level of nonperforming loans continues to rise and for this, there is no easy solution.

While China’s government is holding to its forecast that its economy will achieve a 7% growth rate this year, the financial markets are not buying it. At the low end, some have speculated that the growth rate is as low as 2% and the consensus seems to be in the range of 4%.

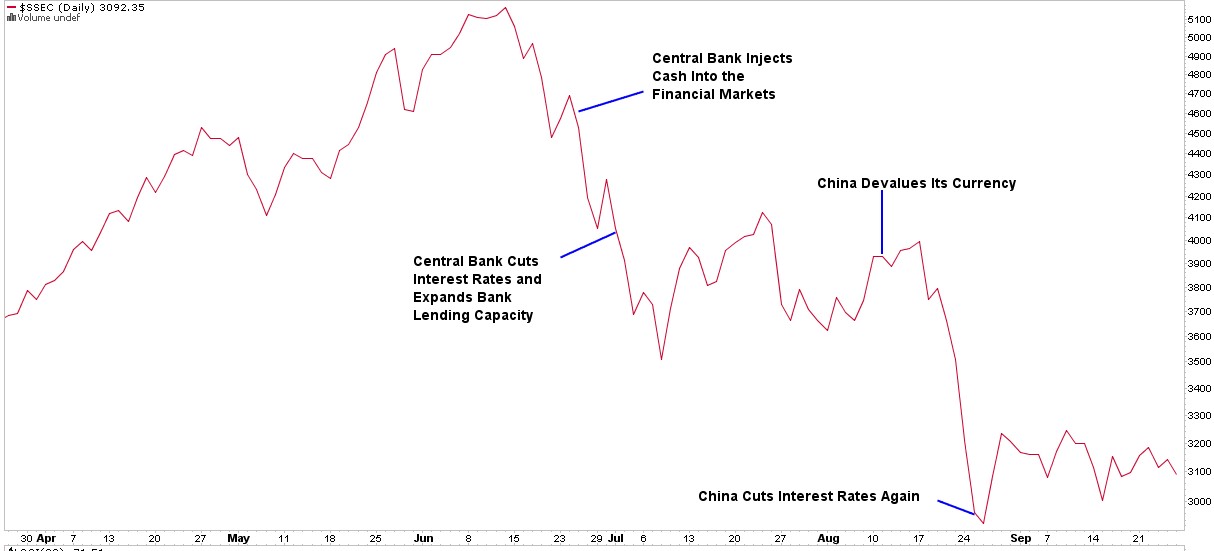

To make matters more difficult, the financial markets have become rattled at the government’s “ham-handed” response to the stock market sell off last summer that caused investors to hundreds of billions of dollars. The government response has included measures ranging from the arrest of over 200 individuals, prosecuting financial journalists and regulators to halting certain stocks from trading at all. This has robbed the markets of confidence in the country’s commitment to reform and the average Chinese citizen’s confidence in the government’s ability to manage things when they go wrong.

At the same time, the surprise devaluation of China’s currency (the Yuan) of almost 2% by the government last month has caused further speculation that China’s leadership is worried about its economy. After all, if they are sticking to their 7% forecast then why go through the devaluation exercise. Just a few months prior to this move, the number two official at the Chinese central bank had all but assured a closed-door gathering in Beijing that this would not be a likely policy path in the event that the economy slowed. The devaluation is aimed at making Chinese exports cheaper for other countries to buy.

China’s exports have been falling due to a sluggish global economy and as other Asian countries have been stealing market share from Chinese companies. The latest data shows that Chinese exports to the European Union fell 12% last July from the year prior and August showed a 5.5% decline compared with last year. China’s Commerce Ministry has stated that the economy is slumping faster than the country’s leadership had anticipated but it will achieve 7% growth. This would be an impressive trick it seems.

The devaluation has rattled investors and many have begun to take their capital out of the country. In response, the Chinese central bank sold an estimated $200-$400 billion of US treasury bonds over the last several months and used the dollars from those sales to buy Chinese Yuan in the open market to help stabilize it. While it is using its stockpile of foreign exchange reserves at a record pace, it still has $3.56 trillion at its disposal.

China’s problems are well documented by now. The reform path that the country has begun to embark on will not be a smooth one but one that is necessary for the long term progress of the country. In the meantime, the rest of the world will likely have to recognize that China will not be growing at the 8-10% levels that so many had become accustomed to. We have to look no further than the troubles Australia is having with its economy to know that China’s ability to provide an economic tailwind will be nowhere near what it used to be. More importantly, given the size and importance of China’s economy, the margin for error for its policy makers is limited.