Inflation Optimism & Recession Fears

In This Issue:

- 2022 was not all bad

- Positive surprises being masked

- China’s policy U-turn is a mixed positive

- Inflation battle beginning to turn

- Mild recession if policy errors avoided

At the start of every year, one of the long-standing traditions in the investment world is for strategists to publish their outlooks for the coming year. These publications then serve to provide fodder for the media to generate headlines and viewership. What goes unmentioned is that these forecasts are usually well off the mark, compared with what actually happens.

Looking back at 2022, it was an eventful year – mostly for unpleasant reasons. The year saw an invasion of Ukraine bringing war to Europe; the United Kingdom saw three British Prime Ministers following the forced resignation of two of them; inflation fears; recession fears; the wiping out of over $2 trillion of value from the global cryptocurrency market; a draconian lockdown in China to contain COVID and a rapid cooling of its real estate sector – not to mention the passing of Queen Elizabeth II – ending a reign that was so long that over 90 percent of Earth’s population has been born after she became Queen.

In the global stock market, over $18 trillion in market value was lost. Usually, the bond market offers some solace to investors given that bonds have fulfilled a traditional role of being able to balance out the risks to stocks in times of turmoil. Unfortunately, the rise in inflation and tighter monetary policy around the world saw bonds lose over $12 trillion in market value. This left investors few places to hide.

Positive Surprises

Given this ominous list of negative surprises – partial as it is – it is easy to see why many have waived an enthusiastic good-bye to 2022. Beneath the surface, last year held some significant positive surprises – and thankfully, some of these outcomes defied the gloomy consensus of the experts that developed through the year.

Lower Energy Prices Helped

Europe has not been a fountain of positive headlines for a very long time, but a significant positive surprise arrived in 2022 courtesy of the energy markets. At the onset of the war in Ukraine, it was logically assumed that Europe would feel the pinch from being cut-off from Russian oil and natural gas – especially during winter. Taking this a step further, the energy shortage in the heart of winter was going to worsen inflation, harm the economy of Europe and undermine support for Ukraine from a beleaguered population. Instead, due to a combination of conservation measures, a moderate winter and an influx of natural gas supply from Norway, Africa and North America – European natural gas prices have collapsed by nearly 85 percent from the peak levels of last year. In the US, gasoline prices peaked in the fist half of the year and dropped by nearly 40 percent from their peak levels from the summer of last year.

Since energy prices are reflected in the cost of most every good produced or service delivered, they are a key component of the inflation equation. If someone had predicted that oil prices would peak eight days after the invasion of Ukraine began, that very prediction would have likely been “laughed out of the room.” That is exactly what happened.

Oil Prices Likely To Go Higher

Like most anything, the price of oil is ultimately determined by supply and demand. From this perspective, the future for oil prices should reflect significantly higher prices compared to their current levels. Therefore, the almost 50 percent price drop from the peak in February of last year is likely to be temporary. Current data shows that global demand for oil exceeds supply and the shortfall in supply is being met by the drawing down of global oil inventories. This cannot continue for long without oil prices spiking once again. According to Russell Hardy, CEO of Vitol – the world’s largest independent oil trader – “The supply situation is getting quite concerning…there’s a concern on the supply side which will probably drive prices higher.”

In the short term, concerns about a potential economic slowdown and weak demand for crude oil by speculators who buy oil to hopefully sell it at a higher future price have helped to keep oil prices in check. This price weakness comes even though oil consumption sits at an all-time high at slightly above 100 million barrels per day while global oil inventories are at their lowest levels in almost 20 years.

In the US, the economic data is showing that supply chain challenges are easing, inflation is slowing and the economy has lost considerable momentum but continuing to move forward. While the unemployment rate continues to be low, many companies are announcing layoffs – and this is being led, perhaps surprisingly, by the Technology sector. The sector had become a focus of criticism from investors who were growing weary of seeing technology companies hiring at a rapid pace while not focusing on the potential for an economic slowdown. So far in 2023, the US technology sector has announced the reduction of over 60,000 jobs in their global operations.

China Complicates Inflation

In October of last year, China’s leader, Xi Jinping, was elected for an unprecedented third term. Many observers had stated that China would not be investable as it was likely that the country would further move towards a state-run economy. However, yet another positive surprise has come about – courtesy of a policy change in China. Since Xi’s election, China has reversed-course on its COVID lockdowns; announced some stimulus measures for its battered real estate sector and made announcements about wanting to continue to move its economy forward. Both the lockdowns and the turmoil in the Real Estate sector have created angry protests that have likely caught the country off guard.

This turn in policy from the Chinese government has been welcomed by the financial markets. The consensus was that the Chinese leadership was willing to sacrifice economic growth in the second largest economy in the world to increase its grip on the country.

Good News Might Not Be Helpful

While markets are cheering the news from China – at least for now – it can be argued that at a time when the US Federal Reserve is intent on showing its resolve to put the inflation genie back into the bottle, the news out of China is not comforting to the Fed’s view on inflation.

A pickup in Chinese economic growth would increase demand for most commodities and that would undo some of the progress made in bringing inflation down. Whether it would be significant enough to alter the downward path on inflation is yet to be determined. So far, copper and aluminum prices have defied the worries about a recession on the horizon and have rallied over 10 percent in the last month in response to favorable economic news from China.

For its part, the US Federal Reserve has wasted no time in highlighting its concerns that a rebound in China might set back the inflation fight in the US. St. Lous Fed President James Bullard told a Wall Street Journal panel recently that China’s surprise policy reversals have “…renewed upward pressure on the margin on global commodity markets. I’m nervous that will lead to upward pressure on inflation…that’s a risk that we have to factor in when making monetary policy.”

European Optimism

As noted earlier, Europe delivered an unexpected positive surprise with its ability to adapt to the severe drop in Russian energy supplies. Before the invasion of Ukraine, Europe imported about 30% of its combined oil and natural gas requirements from Russia. That level has been reduced to only 15% and is likely to drop further.

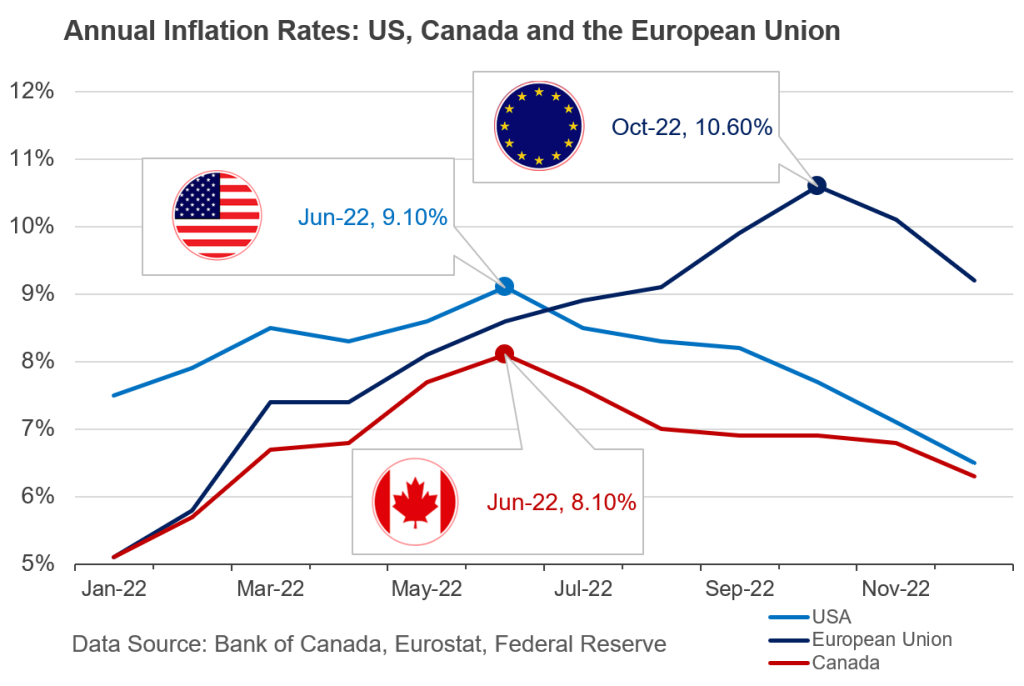

As global energy prices have moderated and retreated and natural gas prices in Europe have collapsed due to excess supply, As the chart shows, European inflation has fallen from a 41 year high of 11.1 per cent to 9.2% during the fourth quarter of last year. This is still about 3 percent higher than in Canada and the US but one major difference between European and North American inflation is that for the latter, it was mostly driven by strong demand – in Europe, the inflation surge has been driven by lack of supply of fertilizer, energy and some consumer goods due to supply chain issues. All three of these are much improved. Hence, CEOs of leading European companies are increasingly mentioning that green shoots of optimism are forming in Europe.

For its part, the European Central Bank (ECB) recognizes that inflation has moderated but it is far too high for its liking given its target rate for inflation to be 2%. The ECB has been explicit in announcing to the markets that it will be raising interest rates in a series of 0.50% increments.

The ECBs caution is backed up by comments to CNBC from Alan Jope, CEO of European based Unilever – one of the world largest consumer goods companies. Jope stated that heading into 2023, his company has seen “extraordinary cost pressure…it runs across petrochemical derived products, agricultural derived products, energy, transport, logistics…but the rate of price increases is probably peaking around now.” Jope went onto state that this still did not mean inflation was beaten – only that it is peaking.

Recession Estimates Varied

The conditions are certainly present for a recession in most parts of the world as manufacturing data continues to weaken. Offsetting this is the global services sector which is still showing decent economic strength.

Economic data in the US shows the manufacturing sector is slowing across the country. In Europe, manufacturing is slowing but has defied expectations by being consistently stronger than expected over the last several months. For Canada, the story is not as optimistic as the weakening in the manufacturing sector is getting worse.

It is this weakening that is giving optimism to bond markets and pockets of the equity markets that central banks are going to halt their interest rate increases.

Optimism: Well Placed or Misplaced?

For their part, the ECB and Federal Reserve have tried to talk down the optimism of the financial markets that central banks are close to ending their interest rate increase policies. The central banks see rising equity and bond markets as a signal that financial conditions are loose and therefore a danger to winning the fight against inflation.

From the perspective of the financial markets, there is increasing concern that central banks are overly focused on where inflation has been and not enough on where it is going (lower). Last year was marked by investors having to walk back their optimism about how far the central banks were willing to take the fight against inflation by raising interest rates. This year, the same investors are doubling down on their bet that inflation will come down quickly and the war on inflation has been won. The optimists believe that this means that interest rates can start to come down again.

But it is worth noting that in the 1970s, central banks declared victory too soon in the fight against inflation and had to respond by raising interest rates to levels that could not have been imagined at the time. Earlier this month, Tom Barkin, the president of the Richmond Federal Reserve Bank stated “…the thing I learned … If you back off while inflation is still elevated, it will come back even higher the next time, meaning you’ve got to do even more damage to take control of it.”

Despite Harkin’s comments, the underlying trend of inflation is weakening. Recent data shows that over the last three months, inflation has fallen to an annualized rate of 2.8% in the US. Currently almost 60 percent of the items measured in US inflation data are showing price deflation. Despite this, policymakers are mindful of past mistakes and are pushing back against the wishes of the financial markets to ease off on the monetary brakes. They are afraid of declaring victory too soon.