Inflation Fueling Markets’ Anxiety

In This Issue:

- Interest rates set to rise

- Investor anxiety is rising

- Markets undergoing a repricing

- History shows worries might be misplaced

For over 40 years, interest rates have been falling across the world. However, the path of interest rates has not followed a smooth path downward. To those with memories of the double-digit interest rates of the 1970s and 1980s, it was easy to dismiss talk about inflation being vanquished.

The generational push towards lower interest rates was fueled by falling inflation numbers around the world. Falling inflation was due to several factors: aging population in the industrialized world, falling labor costs, a global savings glut and the influence of technology and outsourcing in lowering the costs of production of goods and services. Taken together, these factors kept interest rates largely pinned down since inflation and interest rates tend to move together over time.

COVID-19 Changes Inflation Narrative

Clearly, the COVID-19 pandemic has brought about a considerable change to society and the global economy. One of the greatest changes to emanate from the pandemic is the re-emergence of inflation.

One reason for rising inflation is due to the enormous global tidal wave of government stimulus in the form of cash sent out to businesses and households. This has left many with ballooning cash balances that are being spent. The problem is that the increased spending is coming at the same time that the global supply chain has been disrupted. This has created an inability of various industries to produce enough goods ranging from cars and trucks to cellular phones. Even grocery store shelves are not being stocked as regularly and as fully as consumers have come to expect. A perfect storm to fuel inflation has been created whereby “too much money is chasing too few goods.”

The “too much money” part of the inflation equation is also compounded by the effect of near 0% interest rates around much of the world such that interest rates are lower than the inflation rate. This means that the cost of borrowing money when adjusted for inflation is less than 0%! This is an incredible boon for borrowers and a powerful incentive to borrow to spend or to invest. Thus, causing inflation for the price of goods and assets.

In the US, inflation, as measured by the Consumer Price Index (CPI), reached an annual rate of 6.8% in December of last year – the largest one-year increase since June 1982. However, it should be noted that June 1982 marked the peak for inflation from which it began a nearly 40-year decline. Based on demographic data for the US, this means that almost 45% of the US population has never seen inflation this high before. Currently, US inflation is being led by higher housing costs and used vehicles (reflecting the lack of supply of automobiles).

Monetary Stimulus Is More Than Interest Rates

Since the Great Financial Crisis of 2008, the world’s central bankers have stolen the spotlight from heads of state to become the most important actors on the economic stage. To that end, none is more important than Jerome Powell – the chairman of the US Federal Reserve (the Fed). While the world focuses on how many times the US central bank will raise interest rates in 2022, it is at least as important to watch how fast the Fed will “wind down its balance sheet.” This expression refers to how fast the trillions of dollars of bonds the Fed has purchased since the start of the pandemic will be sold off. These purchases are referred to as quantitative easing (QE) and the effect of these purchases was to inject nearly $5 trillion into the financial system from the onset of the pandemic.

This wave of money enters the banking system where it is received as payment for the bonds purchased by the Fed. As the banking system becomes more flush with cash, it has more capital to lend out into the economy to businesses and households. While borrowers did respond and credit usage rose in the US economy, a great portion of the Federal Reserve’s cash ended up in the financial markets in the form of purchases of stocks, bonds and other financial assets. Since interest rates are so low, much of it ended up in the stock market rather than in the bond market where potential returns were unattractive.

The Fed is still purchasing bonds and conducting QE but at a much lower pace than it has been – with a goal of likely stopping completely by March of this year. From that point onward, the Fed will decide whether to hold its bond holdings and simply let them mature or sell the bonds holdings back to financial institutions (thereby drawing cash out of the economy). In effect, this reduces the amount of liquidity in the economy and financial markets.

The decision on whether to actively sell the bond holdings on its balance sheet or to simply let them mature and roll off will be based on how the economy and the inflation picture evolves in the coming months.

Inflation Proving to Be Stubborn

The US Federal Reserve is expected to begin raising interest rates in March of this year. The Fed had been wrestling for much of 2021 with the notion of whether inflation was “transitory” or if it was becoming entrenched in the economy. However, in testimony to the US Senate Banking Committee in late November of last year, Powell stated that it is “probably a good time to retire that word

[transitory]

.” He also recognized the contribution to inflation of supply chains by stating “What we missed about inflation is that we didn’t predict the supply side problems.” Governments and policy makers have learned that shutting down an economy is much easier than the smooth restarting of the global supply chain. Since Powell’s testimony, he has subsequently gone on to say that the monetary policy had to mobilize to confront inflation. In short, interest rates would have to rise.

In Canada, the Bank of Canada is having to choose between fighting a 30-year high in inflation while it worries about a real estate market that has become very heated. The situation has prompted the “Big 5” Canadian banks to call for interest rates to be raised and for caution with respect to real estate prices.

Prior to the pandemic, European policy makers spent over a decade trying to ensure inflation would not fall below 0% (deflation) – which is destructive for an economy. Now the tide has turned and Germany has reported inflation is rising at the fastest rate since WWII. In the United Kingdom, the Bank of England has already raised interest rates once as inflation there is measuring at 30-year highs as it hit an annual rate of 5.4%.

Financial Markets Being Repriced

Powell’s testimony to the US Senate was a gamechanger. Markets no longer have to guess what his intentions are with respect to policy; he is going to tighten the screws. The only question that remains is how fast he is going to be raising interest rates and removing liquidity from the financial system.

In the equity markets, panic and anxiety have set in. The share prices of high-flying software companies, electric vehicle makers and other popular sectors have been crushed. In the US, 40% of the stocks on the technology sector laden NASDAQ Index are down over 50% from their peaks reached last year. Many of these growth companies had great stock price momentum but were not profitable or were wildly overvalued. Exuberant investors and analysts gave these companies the benefit of the doubt – a rising market tends to do that.

Richly valued companies tend to become more vulnerable to the effects of rising interest rates as investors realize that risk levels rise with interest rates. In turn, rising risk levels cause some investors to sell these kinds of companies as they weigh the new risk-reward outlook. In actuality, the repricing mechanism only starts off that way but there is also a herd effect – where selling begets more selling as share prices fall.

It should be noted that at the top end of the NASDAQ are companies such as Microsoft, Alphabet (formerly Google), Tesla, Amazon and Apple. In fact, Apple briefly achieved a market value of $3 trillion early this year. These companies as a group have held up quite well relative to the panic-induced selling seen in most of the technology sector and most of this group generated above- expected growth rates and profitability – despite their enormous size.

Thus far, small-cap companies are bearing the brunt of investor fears. Over the last three months, the Russell 2000 Index, which is comprised of small-cap stocks, is down 15% from its peak reached last November.

Market History Provides Comfort

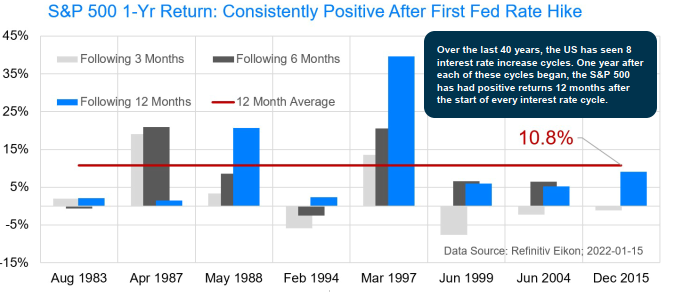

Investors seem to have heard Fed Chairman Powell loud and clear that there is a change coming and as a whole, equity market are clearly panicked. While every market cycle is unique, history shows that investor anxiety about interest rate increases might be misplaced. As the chart on page 2 shows, over the last 8 interest rate cycles dating back to 1983, the S&P 500 has fared well despite the Federal Reserve beginning an interest rate hiking policy.

Using the chart above as a possible scenario for what might transpire in the equity markets, we could see a relatively volatile market with little further progress for the first half of this year but the second half of the year could provide better returns. But most importantly, the US equity market, as measured by the S&P 500, had a positive rate of return one year after the first interest rate increase. As comforting as perhaps the data in this chart is, the markets will need the economy to continue making forward progress and for corporate profits to continue to rise.

Inflation Optimism

Some much needed good news with respect to the pandemic is that it seems to have crested in many nations. The latest variant (Omicron) is thought to help lessen the pandemic by increasing natural immunity. Time will certainly tell if that is the case.

One positive of such an outcome will be that more individuals will rejoin the labor force as many workers do not currently feel that it is safe to re-enter the workforce given concerns about their personal safety. A rise in labor supply will help the supply chain in various industries and ease wage pressures – which tend to be inflationary over time.

Despite the concerns about inflation, the global economy has considerable runway left. Millions of cars need to be manufactured around the world to catch up to pent-up demand and many nations are seeing a shortage in residential real estate that needs to be solved with more construction. These two factors alone should lead to confidence that the economy can continue to grow – despite a change in interest rate policy. Those who say that stagflation (slow economic growth and high inflation)is on the horizon are likely to be proven wrong.

Though the global economy has slowed from the blistering pace of 2020-2021, it is not a cause for alarm as economies tend to settle into a more normal rate of growth as the depths of an economic downturn are left behind. In recent months, economic growth has been restrained by the rise of Omicron but the data shows that each successive wave of the pandemic has had a decreasing negative economic effect.

The best argument against a sustained weakness in equity markets continues to be the fact that generally speaking, equities are not expensive. Despite the rise in bond yields (interest rates), they are still far enough below earnings yields (earnings relative to stock prices) such that a sustained rush out of stocks seems unlikely. Changes in interest rate policy is never comforting but it is not enough to put equity markets on the edge of an abyss.