Economic Blue Skies & Awakening Inflation

In This Issue:

- Global economic growth gathering momentum

- Vaccines have strengthened the economic recovery

- Nations facing different paths out of the downturn due to differences in vaccination rates

- Inflation is going to be a hurdle for the economy

The global economy has come roaring back faster and further than the consensus of economic forecasters and policy makers had thought possible. For perspective, the US economy shrank by 3.5% due to the pandemic in 2020 – the largest annual decline since WWII. It was expected that the lost economic output would take at least 2 years to be regained. Instead, it will take about half of that time.

Vaccines to the Rescue

As much as policy makers deserve great credit for rising to the challenge of the economic downturn last year, the scientists who helped to deliver the vaccine in record time are the real rescuers of the global economy. When the vaccine development efforts were initially contemplated and the US had announced a goal of having a vaccine in place before the end of 2020, it was met with some skepticism. But through some advances in science and Operation Warp Speed (the public–private partnership initiated by the United States government to facilitate vaccine development), the vaccines have not only provided some light at the end of the tunnel but also allowed for businesses, governments and households to plan and build for the future.

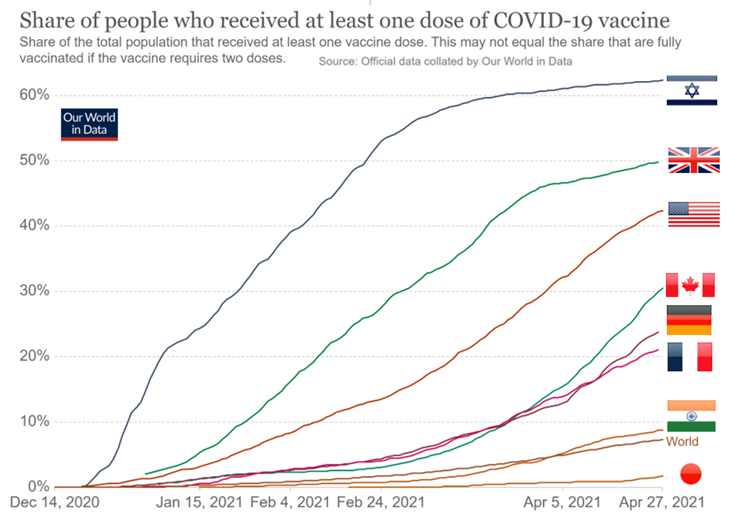

Globally, economic data has been far more positive than expected. But as good as the economic data has been, it is susceptible to risk as there have been varying challenges in the procurement and distribution efforts to get the vaccine out into the global population. In Africa, procurement and distribution have been less-than-optimal and some challenges continue amongst segments of Africa’s population, which are skeptical about vaccines.

Japan has experienced a similar outcome as its bureaucracy and surprisingly poor preparations for distribution have limited its vaccination rates to some of the lowest in the world. Thus far, there have been over 1 billion doses administered globally, which has resulted in 235.33 million people (3% of world population) fully vaccinated and about 550 million people who have received only one dose.

As the data shows below, there is a wide disparity in the developed world with respect to vaccination rates. The US has seen 28.4% of its population fully vaccinated; the UK follows behind at 18.4%; China at about 12.5%; Europe at about 7%; Canada at 2.3% and Japan at 0.80%.

Economic Disparities

The variation in vaccination rates has some potential for marring the economic blue skies. Investors have gone all in on the economic rebound and for good reason. But as history shows, when investors become complacent, some caution tends to be prudent because markets have a long-standing habit of upsetting investor complacency.

India serves as a perfect example of a blue-sky horizon that has turned not only grey but quite dark. Only a month ago, the International Monetary Fund (IMF) had raised India’s forecast for economic growth to 12.5% and it was expected to be the only nation amongst the world’s major economies to see a double-digit growth rate. But the implementation of another lockdown will certainly reduce India’s growth rate as it struggles with a surge in COVID-19 cases. For comparison, China is expected to see its economy grow at about 8%.

In Canada, the IMF expects the economy to grow at 5% for 2021. But Canada serves as a perfect example of an uneven vaccination effort against an improved economic outlook. Canada’s vaccination efforts have improved significantly if single dose vaccinations are measured. It is rapidly climbing up the global comparison rankings. But a resurgence in COVID-19 cases has increased the risks that they could upset the positive economic outlook for 2021. In addition, other nations have advised their citizens to be wary of travel to Canada given the uptick in COVID-19 cases.

Nations Facing Differing Constraints

The Bank of Canada has been the first major central bank to signal that it is looking towards the exits of the stimulus campaign. This past month, it surprised the financial markets by reneging on its commitment made in mid-March that it was going to stay the course and continue to inject money into the Canadian financial system. The booming real estate market and generous fiscal stimulus has heated the inflation waters up enough that the Bank of Canada has become cautious. It now expects inflation to overshoot its 2% target by the most in at least two decades.

It is difficult to say if Canada’s experience is unique to Canada or a foreshadowing of the start of a global exit from stimulus. Canada’s experience is unique because it had the most aggressive fiscal stimulus response amongst the major economies and the Bank of Canada was equal to the challenge as it bought up 40% of all of the outstanding federal government bonds, whereas the US Federal reserve owns only 17% of the US government’s Treasury bonds outstanding.

In Europe, the European Central Bank (ECB) has stated that it is not discussing the phasing out of its emergency bond buying. However, markets have begun to price in small increases in European interest rates over the next year fueled in part by improving vaccination rates and economic data.

Showing once again that each continent is facing a large differential in circumstances some economists are looking forward to a post-pandemic Europe and asking what happens when the financial markets will once again worry that Europe’s commitment to its weaker member economies will decrease. For example, a risk of a reduction in bond buying by the ECB would see Europe’s weakest and heaviest indebted economies face the risk that the markets will once again match their interest rates to their respective credit risks. Currently, Greek bonds maturing in 10 years pay investors less than 1% in interest while 10-year Italian bonds pay less than 0.75%. For perspective, US 10-year Treasury bonds are paying 1.61%. Clearly, markets will have to reprice peripheral European nation bonds to match the risks once the ECB stimulus supports begin winding down. It seems that the weaker economies of Europe were given a reprieve from their financial reckoning day by the COVID-19 pandemic in some ways. But as they recover, the challenge of their debt burden and slow growth economies will re-emerge.

In the US, the Federal Reserve has continued to stick to its official position that it will refrain from raising interest rates until it sees very favorable actual economic data rather than optimistic economic forecasts. However, markets and economists are starting to call out the Fed. In a survey of 49 economists by Bloomberg, nearly half expect the Fed to start trimming its $120 billion in monthly bond purchases before the end of 2021 and interest rates to begin being ratcheted up by 2023, which is ahead of the schedule laid out by the Fed. At the same time, bond markets are starting to price in a gradual rate increase beginning next year.

If it is strong economic data that the Fed wants, it is getting it in spades. In March, the US economy added 916,000 new jobs and inflation is expected to exceed the Fed’s usual 2% target. As strong as the jobs data has been, showing an unemployment rate of 6% and record job openings, Loretta Mester of the Cleveland Federal Reserve stated that “I’m thinking that we’ll see a very strong second half of the year, but we’re still far from our policy goals. It was great to see that report. We need more of them coming our way.”

Risks of Overheating

Historically, the Fed and other central banks have lifted interest rates pre-emptively to head off an overheating economy. Today, policymakers are willing to see inflation make a credible threat to take root before they step in to act. The above-mentioned Bloomberg survey of economists shows that 66% believe that for the US economy, the risks of an overheated economy outweigh downside or neutral conditions. They base this on the fact that the US vaccination program is running smoothly, vaccination rates are rising, large states, such as Texas and Florida, have reopened their economies successfully while a $2.25 trillion infrastructure program from the federal government has been unveiled for approval by Congress.

Higher Corporate Taxes Looming

Stronger than expected economic growth has allowed corporate profits all over the world to exceed expectations—helping to fuel global equity markets higher. Even talk of a rise in US corporate taxes that would lower future profits for shareholders has not cooled off investor enthusiasm.

The proposal from the White House is to see corporate taxes increase in order to raise tax revenues by $2 trillion over the next 15 years. Under this proposal, the US would have the highest effective annual corporate tax rate at 32.4% – just above France at 32%, which is expected to reduce its rate quite substantially by 2022. Slightly complicating the outlook is that President Biden has said that when it comes to corporate taxes “Debate is welcome. Compromise is inevitable. Changes are certain.”

While an increase to the corporate tax rate would dent profits for US companies, so far the economic rebound has allowed investors to focus on the fact that US corporate profits for 2021 are expected to rise by 20%. So far, as the first quarter earnings announcements have begun to filter in, it is likely to exceed that already lofty figure.

One of the potential clouds that threaten to dim the otherwise clear economic skies is inflation. As Sean Darby, a strategist for Jefferies Group states, “The V-shape earnings growth is coming to a summit … What does concern us is the possibility of peak margins given the ferocity of input costs and the growing likelihood of changes in the corporate tax rate.”

Certainly, the potential challenge to corporate profits is coming from a host of factors that are conspiring together to make both investors and corporate executives take notice. Input costs for US companies have risen by 4.2% year-over-year—the biggest annual rise in 47 years. These input costs are for goods and materials such as ball bearings, fuel, chemicals, steel and plastics that are used to make other products. However, it should be noted that we are seeing a base effect take place—in which prices collapsed a year ago—so we are coming up off a smaller number; this makes any rise seem large in percentage terms. But corporate executives are not taking any comfort in this; they know that they are seeing rising cost pressures across the board and it is not due to the base effect alone.

Implications of Rising Costs

For companies with pricing power (i.e. those that have sought-after brands or services), inflation can be helpful to earnings because they can not only pass along price increases but they can enhance margins over time by sustaining the higher price increases once cost pressures subside. But for companies without pricing power, inflation can devastate profit margins and in turn, lead to lower stock prices.

In recent weeks, the CEOs of 3M, Kimberley Clark, Coca-Cola and others have expressed their intention to begin raising prices for their products. The comments of Michael McGarry, CEO of PPG Industries, summarizes what many CEOs are saying this year. McGarry states “We experienced a significant acceleration of raw material and logistics cost inflation during the quarter…With a higher inflation backdrop…we have already secured further selling price increases and are in the process of executing additional ones….” It was noted by Bank of America that the word “inflation” has seen a 300%increase in usage on corporate earnings conference calls. They found that increases in mentions by companies about inflation is correlated to actual consumer price inflation. Clearly, inflation has the potential to become a risk to the post-pandemic recovery.