COVID-19: Paving an Uneven Path to Recovery

In this issue

- Global economy gripped in a historic downturn

- World’s first “forced recession”

- Turning the corner and “flattening the curve”

- Governments have gone “all in” with efforts to stabilize the economy

- Equity markets are trying to price in the extent of the ultimate decline in corporate profits

As 175 countries and territories battle over 2 million cases of COVID-19 – the response from governments has centered on a mandated shutdown of large sections of the global economy. What makes the current economic down-turn so unique is that never in all of history has economic activity been brought to a halt on purpose on such a grand scale.

The hope has been that the instituting of “social distancing” would slow the spread of the virus. This has meant millions of people are either working from their homes and in many cases, thousands of businesses and workplace locations have been closed. It is estimated that about a third of the world’s population is under some form of restricted movement. The sudden shock to the global economy has meant that millions of people around the world have become unemployed. In the US alone, over 16 million people have become unemployed almost overnight and Canada saw a record one million jobs lost in the month of March alone.

While the virus is no doubt a global healthcare tragedy impacting millions of people both directly and indirectly, its effects will be far reaching and long-lasting on the economy. As the growth rate of infections has been reduced (“the curve is flattened”) and as some countries begin to loosen their restrictions to get their economies up and running again, the financial markets will switch their focus to traditional economic metrics that measure the state of the economy. Some have likened the economy’s path this year to a car that was starting to accelerate that then suddenly hit a tree and came to a sudden stop.

The December 2019 news stories about the coronavirus outbreak in China were initially seen as largely a China centric shock. Very quickly, this then turned into a global pandemic. The speed of the economic slowdown has been virtually unfathomable as the global economy started 2020 with an uptick in momentum as fears about the US-China trade war had reached a conclusion. Economic data from three of the largest economies (US, China and Germany) was beginning to show some positive trends.

The global response to the crisis is without precedent in terms of the public-health and economic responses. The extent of the economic damage will depend on how quickly the virus is contained, the steps authorities take to contain it and how much economic support governments are willing to deploy during the pandemic’s immediate impact and aftermath. Recent data from the International Monetary Fund (IMF) shows that the global economy is on track for its worst streak since the Great Depression.

In the US, the fiscal and monetary responses to the COVID-19 economic shock have been well received by most economists and the markets. For its part, the US Federal Reserve used its playbook from the 2008 financial crisis and multiplied the scale of that response – both in terms of size and speed. The quick actions of the Federal Reserve have stabilized financial markets and brought the credit markets a sense of stability.

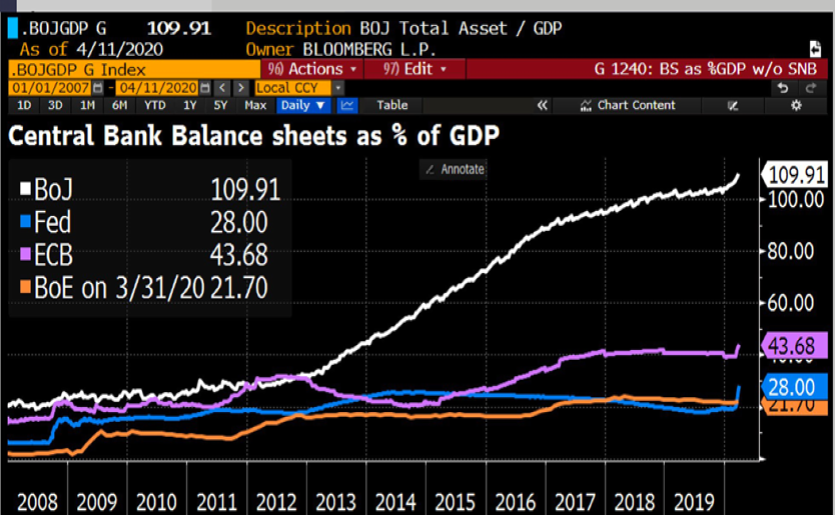

As the chart below shows, the central banks of the United Kingdom, the US, Europe and Japan have raised the amount of monetary injections into the global financial system to counteract the impact of COVID-19. Clearly, the central banks of the world have gone “all in” to inject monetary stimulus into their economies. These measures have helped to calm the equity and bond markets—giving the economy a chance to work through the historic disruptions that have become so apparent.

The US has led the global fiscal response as political rivals worked together to pass a $2 trillion stimulus bill that was negotiated and passed in only 10 days. For comparison, the 2009 stimulus bill during the Great Financial Crisis downturn was $830 billion. The sense of urgency was summarized by Douglas Holtz-Eakin, the former Congressional Budget Officer during the Bush Administration, when he said “If we don’t stem this cascade, there isn’t any economic activity in the US that isn’t endangered. It’s unbelievable.”

Investors are digesting the implications of disrupted supply chains, official containment measures and spillovers from the financial markets to the real economy. The financial markets are trying to price in how long this epidemic will last and its economic impact. Given the unprecedented nature of this downturn, the stock and bond markets have seen an incredible level of volatility. Understandably, this has left investors with a heightened sense of anxiety.

Demand Shock

The current economic downturn has earned its own special place in the field of economics. The global economy is seeing the effects of the mandated shutdown of large parts of the economy that has helped to cause the world’s

first ever “planned recession.” Economic downturns usually consist of a fall in demand (demand shock) that takes place in response to a downturn in the economy. The current demand shock to the global economy is being fueled by the loss of income, fear of economic contagion and heightened uncertainty—all of which cause consumers and households to reduce spending. Given that consumer spending represents nearly 60% of the global economy and almost 70% of the US economy, these headwinds are a large part of the reason that the global economy has come to a sudden stop.

Recent data for the US economy shows that retail sales have fallen by a record amount and industrial production has seen the largest decline since the end of WWII. Canada’s economy is also experiencing similarly historic levels of contraction in key sectors.

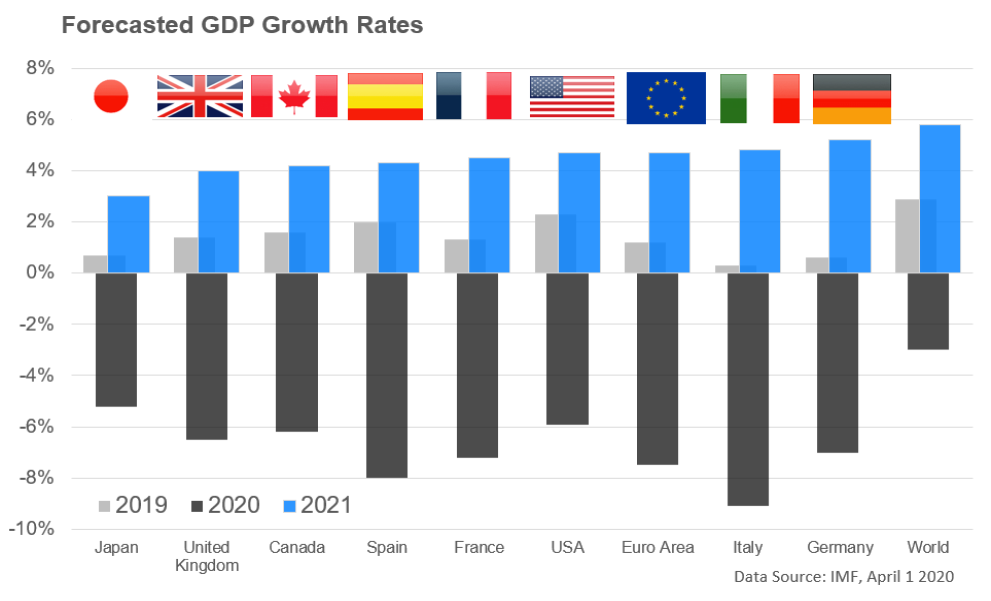

As the data on the chart below shows, the IMF is forecasting significant declines in the global economy but next year will see a reversal back towards positive growth rates. The economic slowdown is truly global in scope. According to the latest data from the IMF, Asia will have 0% economic growth in 2020—which is the lowest growth rate in 60 years. However, this is better than the negative 3% growth rate for the global economy as a whole.

Supply Shock

The current downturn is also being amplified by the fact that there has been a supply shock to accompany the demand shock. The supply shock comes from the closure of the economy’s productive capacity across the globe. First and foremost, the supply of labor has been reduced due to social distancing, job losses and health challenges.

Furthermore, as thousands of companies have come to rely on globalization to fulfill their supply chain, a supply chain risk has been laid bare. A problem in one part of the world can halt production of goods across the world. Increasingly, investors will look to evaluate companies in the future based on their assessment of their respective supply chain risks. In addition, many countries will be looking at their own respective vulnerabilities to the global supply chain and will likely be undertaking comprehensive reviews.

Mapping a Recovery

Early indications from some US states and some European nations is that certain parts of the economy will be given the green light to “reopen.”

Most economists have taken to use various letters of the alphabet to describe what the recovery will look like once various countries decide to give the economy the green light to open up. The letters U, V, W and L are most commonly used to describe the economy’s potential recovery path.

At this point, it seems that the V-shaped (rapid) recovery is not a likely event given the economic dislocations that have been created in the last few months. It is simply too much of a stretch to assume that the economy can recover rapidly. In a recent interview, Neel Kashkari, the head of the Minneapolis Federal Reserve, stated that “This could be a long, hard road that we have ahead of us until we get to either an effective therapy or a vaccine. It’s hard for me to see a V-shaped recovery under that

scenario.”

The proponents of the V-shaped recovery point to the incredible amounts of stimulus that have been injected into the economy by governments around the world. They believe that the stimulus – along with the lifting of the lock down – will push the economy back to its previous growth path.

While the stimulus has been a tremendous stabilizer to the financial markets, it only helps to pushback somewhat gently against the economic deepfreeze. For that reason, the most likely scenario is a U-shaped recovery, which implies that the recovery will be slow and steady for one to two quarters before economic momentum can gain steady traction.

At this point, a W-shaped recovery (which involves a double-dip recession) is not likely given the enormous stimulus that has been injected into the global economy by central banks and governments around the world.

Since 2019, there have been over 50 interest rates cuts and trillions of dollars of fiscal stimulus in the form of tax cuts and spending increases.

On an optimistic note, there is a path out of this crisis. The first step was the flattening of the curve or rate of infection. The second step is a slow and gradual easing of the lockdown conditions.

At this point, many questions remain to be answered. For example, there is great debate as to how consumer spending patterns will change or for businesses, there is a question as to what the global supply chain will look like. There could even be a need for one more round of stimulus. Though the current crisis has deeply impacted the world, there is a visible but uneven path forward.