Balancing AI’s Promise and Bubble Fear

In This Issue:

- US legacy of technology leadership

- AI investment fueling US economy

- Tech sector spending on AI leads to bubble fears

- Today’s tech investment is funded mostly by cashflow—not debt

Since the end of World War II, the U.S. economy has consistently distinguished itself from the rest of the world. It has remained the economic engine of the global economy while being able to transition from an industrial powerhouse to the leader of the information age. This transformation began with the development of ENIAC in 1945, widely recognized as the world’s first programmable computer. The momentum continued into the 1960s with the creation of ARPANET, the precursor to the internet, which ultimately led to the emergence of the World Wide Web in the 1990s. From the early foundations of computing in the 1950s to the digital revolution of the late 20th century, a consistent thread has been U.S. innovation—driving technological progress and reshaping the global economic landscape.

The constant striving towards innovation from seemingly humble beginnings has created the world’s largest corporations. Companies such as Microsoft, Google, Oracle, Intel, and Nvidia continue to propel technology forward. Other companies, such as Amazon, exist in large part because of what came out of the origins of ARPANET. It is important to note that many of today’s technology giants are successful because they had the ability to reinvent themselves as technological change came. Those that could not adapt were left behind and either swallowed up by more nimble competitors or faded out of existence. This is an important distinction to make because this renewal has kept the US economy in the pole position amongst global economies.

Today, the rise of Artificial Intelligence (AI) is the latest technological revolution. While technology will undoubtedly evolve its definition, AI can be thought of as the ability of computer systems and software applications to perform complex tasks requiring reason, learning and decision making. In short, functions that once required human intelligence are increasingly being done by computer systems—and the US leads the global AI race.

Recently, the Managing Director of the International Monetary Fund (IMF), Kristalina Georgieva, stated that “The AI investment boom is bringing incredible optimism – mostly concentrated in the United States.” Data from Ernst & Young shows that in 2024, global private AI investment reached $252.3 billion – a 26% increase from 2023. Of this amount, the US accounted for nearly 45% of the global total and this was 12 times the level of AI investment in China and 24 times the level of the UK.

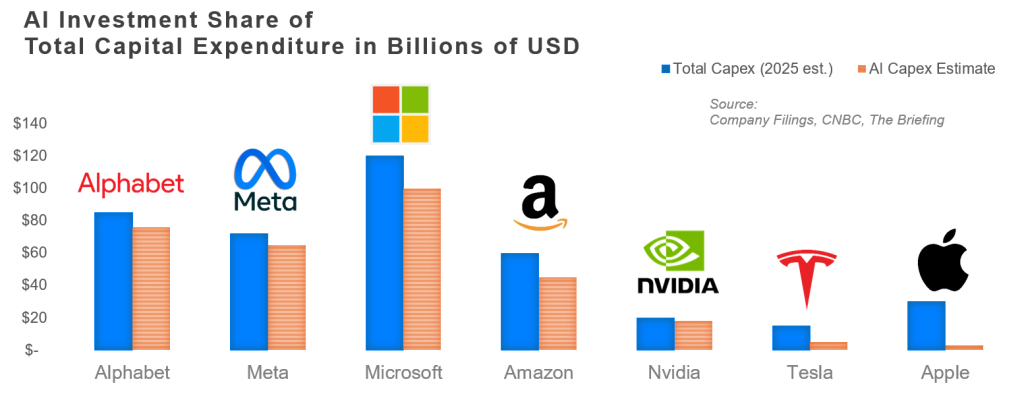

With respect to AI infrastructure such as data center construction, the so-called “hyperscalers”—Amazon, Microsoft, Google, Meta and others—are driving an infrastructure supercycle as the chart below shows. Their aggregate capital expenditures (“capex”) on data centers, computational hardware (especially GPUs and AI accelerators), and power generation have neared or exceeded $350–400 billion in 2025 (a fourfold increase from just a few years prior).

Emergence of AI

The advent of technological progress has had an unmistakable impact upon people across the world. From cellular phones possessing levels of processing power that would have astonished the computer scientists of a generation ago to the incredible changes brought about by the internet to every industry and country across the world – the world has shown an ability to adapt and prosper from technology.

According to a survey conducted by global consulting firm McKinsey, 50% of the survey responding companies were using AI-enabled technology in at least one segment of their business and many are seeing efficiencies due to lower costs and some are able to translate their AI usage into higher revenue. A 2023 study by Statista found that the sectors that benefit the most from AI adoption include manufacturing, service operations and marketing and sales. Statista found that 4% of the companies it looked at were able to reduce costs by at least 20%. Importantly, these numbers match the numbers that McKinsey found. Fortune magazine has gone so far as to say AI is “the holy grail of cost reduction for CFOs”.

AI and Pharmaceuticals

The impact of AI is being seen in various industries with the promise of much more to come. In the healthcare sector, AI is being used to help researchers speed up research into new drugs by analyzing complex datasets in a fraction of the time a team of scientists would be able to do it. It is helping pharmaceutical companies with making drug trials more efficient and reducing the likelihood of drug failures. Historically, the development of a new drug has required a decade and billions of dollars. AI will change that as AI is able to identify illnesses with more precision, to help with drug development and optimize clinical trials and speed up manufacturing.

AI and the Mining Industry

The global mining industry has also made large strides using AI. For a number of years, the global copper industry has warned that it will not be able to produce enough copper to meet the coming demand over the next 20 years given current discovery rates and the multi-year timeframes involved in getting a mine into production from the time an ore body is discovered.

AI has benefitted copper miners – and other mining sectors – by enhancing operational efficiency. AI’s predictive capabilities are being used to help mining companies extract millions of tonnes of ore from the earth in ways that are more efficient than using human experience or intuition.

Mining industry studies conducted by consultants have shown that up to 76% of copper mining projects are showing cost savings after AI has been adopted. AI-enabled predictive maintenance has extended the replacement cycle of equipment by 21% and reduced downtime by 18% and saved on fuel consumption by 12%. Not only are these financial tangibles but AI is helping the mining industry reduce its environmental impact. In addition, at a time where building new mines is becoming increasingly more difficult, AI in copper mining is increasing recovery from mined ore by 7%.

Skepticism and “Bubble” Worry

Increasingly, media headlines are starting to point to the AI technological revolution as being a “bubble”. It is important to note that there is no accepted definition of what constitutes a “bubble” and that is largely because it is not always easy to differentiate between hype and reality. From our perspective, there are some broad similarities between the 1990s buildout of the internet and today’s spending on the datacenters that power Artificial Intelligence and importantly some significant differences.

In the 1990s, the telecom industry and other startups invested hundreds of billions of dollars into building internet infrastructure such as fiber-optic networks. This investment was largely funded by debt as the companies that were building the networks were often not generating anywhere near the cash that they needed.

The companies that built the internet were generating negative free cash flow compared to the nearly $250 billion being generated by the AI Hyperscalers. This difference provides some confidence that thus far, the AI build-out is sustainable. During the internet bubble, the builders of the telecom and networking infrastructure that built the foundations of the internet overstretched themselves and overbuilt capacity. Eventually, many of these companies collapsed under a burden of debt.

Today’s AI champions are generating rising free cashflows and nearly all of them have considerable borrowing capacity. In short, they have the balance sheets to support their forecast for AI related demand and the investment spending that it will require. Furthermore, the AI infrastructure providers are seeing a nearly insatiable demand for more and more computing power to be deployed. This means more data centers get built, more spending on semiconductors and more demands for electricity. This is a key difference from the “dotcom” era build out of the late 1990s and early 2000s. Then, there was little focus on where the cashflow was going to come from for companies to earn a significant return on the buildout of the internet. In fact, as history shows – there was little in the way of sufficient return on capital.

Hurdles for AI to Overcome

Up until recently, there was little question that the AI revolution was being funded in the right way which is from companies’ own cashflow and some borrowing but the borrowing is being done by some of the most cash rich companies in the world.

All signals from the technology industry continue to indicate that there is a continuation of a shortage of capacity to meet the coming demand for AI technology. OpenAI has been one of the pioneers in the AI space but is also considerably smaller than tech giants such as Alphabet (Google), Microsoft, Oracle, Amazon or Meta. But that has not stopped the optimism of OpenAI one bit. In recent weeks, OpenAI has announced an unparallelled scale of deals with Oracle, Nvidia and AMD to supply it with capacity and computer chips to meet the forecasted demand for its AI technology. OpenAI executives have described demand for its AI offering to be “voracious” and stated that OpenAI will have to spend “trillions” for AI to match its potential. As OpenAI CEO Sam Altman stated in the aftermath of its flurry of deals – “Our bet is, our demand is going to keep growing…and we will spend maybe more aggressively than any company who’s ever spent on anything ahead of progress.”

If OpenAI’s deals as announced come to fruition over the next several years, it will require new electricity capacity in the US that is staggering. It will require the US power grid to generate and deliver power equivalent to the output of 17 nuclear plants or about 9 Hoover Dams. This is the amount of electricity needed to power about 13 million US homes. If power supply is inadequate it could temper the growth of AI.

AI Providing Tariff Shield

In the first half of this year, economists were trying to update their models to forecast the potential impact the US tariff and trade policy would have on the global economy. It has been said for decades that when the US economy sneezes, the rest of the world catches a cold and that is still true since the US represents 26% of global GDP.

The concerns about the global economy have faded slightly as trade deals were announced between the US and most of the globe’s economy – with China remaining a glaring exception. For Canada and Mexico, trade talks are ongoing and there is a mixture of hope and angst that the upcoming USMCA free trade agreement will be reviewed without too much friction.

While the tariff agreements have calmed the economic waters somewhat, the US economy has also been shielded by enormous spending on AI related infrastructure and investment. As the fourth quarter has begun, the International Monetary Fund (IMF) has upgraded its forecast for the global economy to rise by 3.2 per cent this year – in line with the 3.3 per cent growth rate of last year. The IMF forecasts the US to lead the G7 leading economies with economic growth of 2.1% (by far the largest growth of the group) but it should be noted that the Atlanta Federal Reserve Board is forecasting that third quarter GDP will be closer to 3.9% and this follows second quarter’s revised numbers of 3.8% growth. It is safe to say that the IMF forecasts look a bit too low for the full year economic growth estimate. For comparison purposes, the IMF expects the United Kingdom to be on track for economic growth of only 1.3% this year – the second strongest growth rate in the G7.

Economists are recognizing the outsized impact that AI-related investment is having on the US economy. As we have noted above, this surge while welcome – is not indicative of being an all clear signal. The investment has to yield positive economic impact beyond the initial investment related “sugar high” or there is risk that this engine of economic growth will fade. Europe is certainly showing economic weakness once again as AI investment has not materialized there to anywhere near the scale it has in the US.

The risk for the US is that the AI boom turns into an AI bust. The optimism around AI has led to US tech giants funneling over $300 billion this year into AI investment spending and total AI investment now accounts for almost 40 percent of US GDP growth this year. In turn, AI related companies have accounted for 80 per cent of the rise in US equities so far this year. The AI boom has drawn in capital from all over the world and the talk earlier this year related to “the end of US exceptionalism” has faded.

The ripple effect of the AI boom lifting US equities is that consumer spending by the wealthiest households is rising and fueling the US economy. Estimates from economists have consistently shown over the years that the wealthiest 10 percent of US households own 85 percent of US equities. Recent public and private sector data shows that this group of households accounts for half of consumer spending – the highest share on record since this data point began being collected. Clearly, the AI boom has helped to shield the US economy from tariff fears and fuelled its continued resiliency.

Questions About AI and the Future

The optimism surrounding AI is clearly elevating it to the “next big thing” category. If AI is able to match up to the expectations of its proponents and the technology companies that are spending billions of dollars to build it out then it will increase worker productivity and make the global economy more efficient. It will create new industries and new jobs and enhance innovation and decision making. Furthermore, it will solve complex problems in sectors such as healthcare, space explorations and manufacturing. There is little doubt that the technological achievements of AI that are apparent today and are yet to come will bring enormous benefits over time.

From an investment perspective, the challenge is going to be for the hyperscalers and venture capitalists to continue to be able to generate a significant rate of return on their investment. As we noted, there is no agreed upon definition of what constitutes an investment bubble – we only know that the after effects of one are damaging to markets and the economy. In all likelihood, there are still significant returns to be earned by investments into AI by companies in the technology sector. At some point, investment in AI will begin to overbuild and profitable investments in AI begin to become less profitable. As long as the technology giants maintain discipline on their spending and invest in accordance with potential profitability, AI might be one of the few investment booms that avoids the bubble label.