Global Economy in Need of a European Assist

Over the last 20 years, a disconcerting trend of slowing rates of economic growth has taken root in the economies of the developed world nations. What was once considered to be a temporary aberration has become accepted as normal as the developed world has seen a long-term erosion in economic growth (GDP) rates. Whereas 3% plus GDP growth was seen to be “steady but unspectacular growth” in the 1980s and 1990s for Europe and North America, economists are foreseeing 2% plus growth as “steady but unspectacular growth” today. In short, 2% GDP growth seems to be the “new normal.”

The reasons for the drop-off in economic growth range from a lack of new game-changing technological innovations, slowing productivity, ageing societies and excessive amounts of debt that have built up over the last 20 to 30 years. During this time, the world has increasingly relied upon the US (the largest economy in the world) and China (the second largest economy in the world) to deliver the lion’s share of global economic growth.

But the world could use an assist from Europe (the European Union). The European Union (EU) represents a block of countries that when taken together has an economy that is second in size to only the US. While most of the developed world (including the US) has been contending with lower-than-usual economic growth rates, in the case of Europe’s economy, it has been a much longer-term challenge.

Until about six months ago, the world economy had looked like it was heading for the best rate of growth in over a decade and economists were comforted by the fact that for the first time in a long time, this growth was synchronized (i.e. all the major economic blocks were seeing economic momentum). In fact, Europe’s economy was able to pull off a rare feat by showing slightly faster growth rate than the US in 2017 and early 2018. Unfortunately, shortly thereafter, the wheels came off the global economy and the synchronization in growth was replaced with “synchronized slowing.” Economic worries have returned once again as Europe’s growth spurt has faded. It finished 2018 with its economic growth rate falling to its lowest level in four years by the back half of 2018.

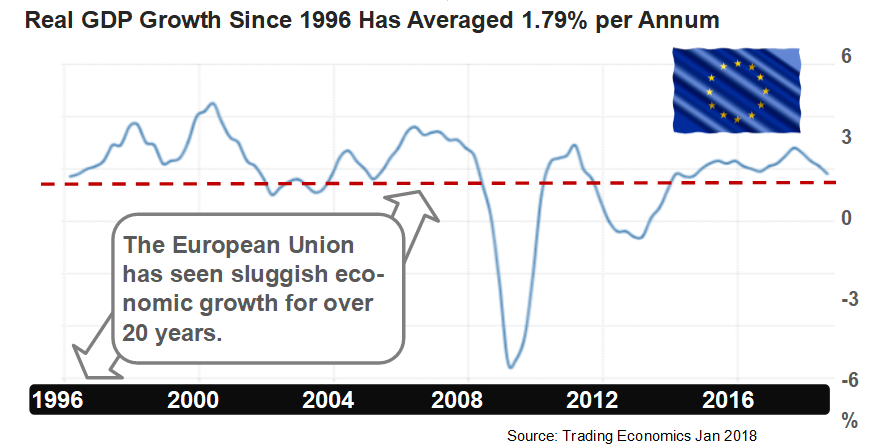

Figure 1: European Union’s real GDP growth over the last 20 years.

While all parts of the world are undergoing a shared experience of lower economic growth, in Europe’s case, it has been particularly acute. The 28 member nations of the European Union have a combined population of 512 million and GDP of $19.2 trillion (compared to the US at $20.5 trillion). Despite its size, Europe’s economy has not been pulling its weight in the global economy as Figure 1 above shows. Europe’s generational malaise has resulted in annual GDP growth rate since 1996 of only 1.79%.

What Ails Europe’s Economy?

The policy fix for the European economy will not be easy as it is difficult to get 28 nations to agree on much of anything and where reforms are resisted by the population.

Europe’s slow rate of economic growth has become a relatively permanent feature. A whole generation has seen nothing but sub-par economic growth and relative stagnation. For example, in Italy, the growth in real per capital income has been close to zero over the last 20 years while in France, it has risen at under 1% per year. Other than periodic bursts of energy, economic momentum has been hard to come by. Discussions about what ails Europe can likely fill up an Economics textbook. However, the consensus is anchored around archaic regulations, high taxes, rigid labor laws, bureaucratic overreach that prevents innovation and political friction between the EU’s member nations.

This last point can easily be seen in the current Brexit (“British Exit”) dispute whereby the UK is negotiating its exit from the European Union. Many observers point to the dysfunction and division within the UK government as being synonymous with the governing problems of Europe. The effect of a dysfunctional UK government has eroded business confidence as companies wait for more clarity as to how Brexit will resolve itself. According to the terms of the Lisbon Treaty, the UK has until March 29th to get a deal done with the EU.

Other disputes within the European Union involve Italy and formerly Communist countries such as Hungary who want to be able to establish their own border rules and government spending limits. As the upcoming May elections for the European Parliament come into focus, many observers fear the rise of formerly fringe parties whose popularity has risen as voters have grown exasperated at the present order of things in Europe.

Germany’s Worrisome Economy

Germany makes up 28% of the European economy and this makes it the largest economy in Europe. Germany is seeing its longest run in economic growth since 1966 but its economy has slowed sharply with economic growth falling to the slowest rate of growth in 5 years. This was somewhat better than expected as falling German exports to China were offset by rising consumer spending and a low unemployment rate of only 3.5%. One point of optimism is that the economic slowdown was due to temporary factors, such as falling auto production as Germany introduced new auto emissions standards. Still, in recognition of the change in economic momentum, the European Central Bank (ECB) has said that risks now have shifted to the downside. Markets are now assuming European interest rates will stay where they are—rather than being set to rise as assumed in early 2018.

Europe Marching to Its Own Drumbeat

The European Union took a different tact to digging out of the last recession than the US and China. These nations chose to stimulate the economy through tax cuts, easy monetary policy and increased government spending. The EU reluctantly followed the easy money policies of the US, Japan and Canada but offset this with demands for fiscal austerity amongst its member nations. The result was a near decade of lost growth.

It is expected by some economic observers that other countries will try to copy the US policy book and use fiscal measures, such as tax cuts, to stimulate their economies. According to Daniel Clifton, of research firm Strategas Research, investors should “expect to see a wave of global fiscal policy in 2019. There is a global race for capital taking place and with non-US growth slowing, voters are unhappy. Politicians will need to deliver growth in 2019. US growth accelerated in 2018 while other regions slowed. This creates neighbor envy and more countries are looking to cut taxes.”

It seems that the US might have set off corporate-tax-cut fever in parts of Asia and Europe and it would not be the first time. When the US cut corporate tax rates in 1986, many developed economies followed the US lead. Today, it is Europe’s economy that is most in need of an economic shot of adrenaline from a tax cut and it is encouraging that the successor to German Chancellor Angela Merkel, Annegret Kramp-Karrenbaue, has already begun to advocate for tax cuts even prior to officially assuming office. Given Germany’s influence in the EU, this could be a significant step forward for Europe.

China Experiencing Its Own Slowdown

China is Germany’s largest trading partner. So China’s economic troubles are sure to have an impact on Europe – a region that has hardly been at the forefront of economic dynamism for quite some time. Recent data shows that China’s economy grew at 6.4% in Q4 2018 (its slowest pace since 1990). To combat this, China has adopted measures to increase investment and spending. The Chinese government has centered its strategy to help its economy rebound by introducing a series of tax cuts and rebates for small businesses. These add up to $410 billion US and are equivalent to about 3.5% of China’s GDP. This is in addition to tax cuts for manufacturing companies and increased deductions for R&D spending. There are also calls from some economists in China for the government to cut the overall tax rate from 25% to 15-20% for businesses in certain sectors.

China’s problems are due in part due to its trade dispute with the US. The friction has sapped the confidence of business and forced many of them to put investment plans on hold. Some companies have even resorted to layoffs —a measure which is often discouraged by China’s stability-obsessed Communist Party. But some economists believe that the slowing economic growth rate was also partly self-inflicted as China has been trying for two years to limit the economy’s reliance on excessive borrowing and get a handle on the buildup of debt throughout its economy. To achieve this, China’s government had been restricting the access to credit for the Chinese economy.

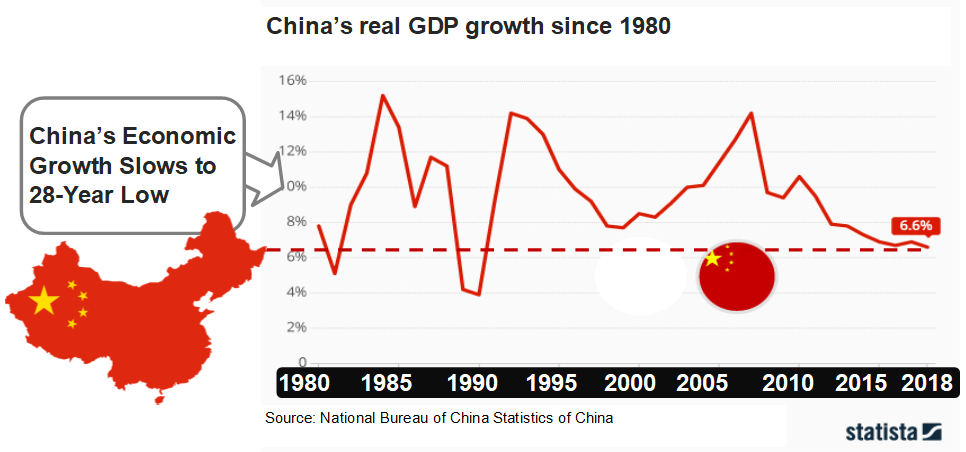

As Figure 2 below shows, China’s economic growth rate has been gradually decelerating for some time. China’s policymakers have a tough task ahead of them: fend off a US challenge to open up its economy to US goods and services, clean up the debt mess of previous stimulus programs and maintain 6.5% annual economic growth. Quite a task!

Some are wondering if China would revert back to the type of large-scale monetary stimulus such as the 2008-2010 and 2014-2015 stimulus efforts that led to huge buildups in debt. This is despite statements from China’s central bank put out earlier this month stating that “The central bank will avoid damaging the real economy with too fast credit shrinkage while refraining from indiscriminate easy credit.” Officially, China’s authorities are saying that they plan on “maintaining steady and healthy economic growth” and would avoid the damage caused by indiscriminate lending. But some critics fear that if its back is against the wall, it will resort back to economic shortcuts.

Figure 2: China’s real GDP growth since 1980.

The US, China and Europe

Clearly, the economic data shows global economic momentum has decelerated. It is encouraging that the US Federal Reserve is leaning towards moderating its policies towards raising interest rates. In China, the authorities are aggressively confronting the slowdown within the constraints mentioned above. A great assist will come to the global economy if Europe’s economy can break out of its rut and lend a helping hand to global growth and ease the concerns of financial markets.