A unique opportunity to invest in our pooled fund.

The $38 million fund invests in equities and bonds, as well as select alternative assets to manage volatility with a dynamic asset mix and sector rotation strategy.

It's an ideal fund for investors looking for a unique and sophisticated investment vehicle that is “non-indexed” yet provides diversified exposure to core asset classes and sectors.

Investment Holdings

The Tactical Balanced Fund's equity holdings include large U.S. and Canadian market capitalization companies, with a bias toward dividend growth stocks. We supplement those with investments in select international companies.

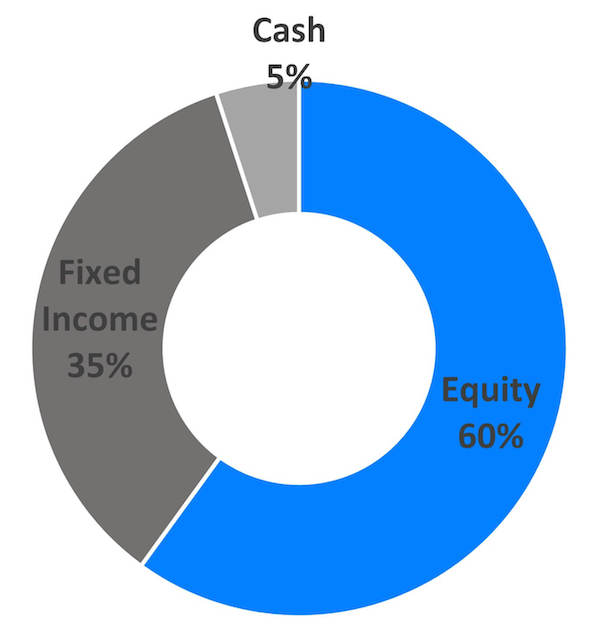

Benchmark Asset Mix

We base our asset mix and sector rotation decisions primarily on a top-down investment approach that uses macroeconomic and broad market factors. We base our individual security selection on a bottom-up approach that involves examining the specific attributes of each company.

Fund Details

- Manager: Pacifica Partners Inc.

- Auditor: KPMG LLP

- Counsel: Borden Ladner Gervais LLP

- Custodian: National Bank Independent Network

- Administrator: Commonwealth Fund Services

Units of the fund are valued monthly.

View the fund’s monthly performance on Fundata.

Historical fund performance, current sector allocations, and current fund holdings are available for clients of Pacifica Partners. Please speak to a Pacifica Partners advisor for more detail.

Book a Complimentary Consultation