Markets Distracted By the Trump Phenomenon

It is difficult to think of a US President who has dominated the market’s psyche the way Donald Trump has. The sugar high of the Trump tax cut has been absorbed by the market and is now almost forgotten. Investors can certainly be excused for feeling anxious as their optimism has been replaced by fears about trade wars, disputes with NATO allies, reopening of sanctions on Iran, and the resulting fall in oil prices.

While the media is pre-occupied with the so-called Trump effect on the list of topics mentioned above, the unexciting but perhaps even more impactful policy of higher US interest rates is being ignored. In the developed markets, the US Federal Reserve (the Fed) is alone in vigorously pushing the cause for higher interest rates. Other nations, such as Canada, are taking more tentative steps towards raising interest rates.

Though the Fed has not been explicit, it is likely being motivated by tightness in labor markets with unemployment near all-time lows and some industries seeing shortages of workers. The trucking industry in particular has been hard hit by labor shortages. Earlier this month, Pepsi cited driver shortages for its profit drop in its North American beverage unit. The most recent data shows that trucking costs are up almost 8% year over year. One recent estimate from Morgan Stanley showed that about 75% of freight in the US is moved by truck and labor costs are about 40% of the trucking industry’s sales. In order to attract workers, the trucking industry is going to have to start raising wages. Needless to say, at some point—those higher wage costs are going to be passed on to the consumer to some extent. This helps to spur inflationary pressures and is likely to cause the Federal Reserve to stay vigilant and continue to raise interest rates as long as it thinks inflationary pressures are mounting.

The most recent readings show that inflation at the wholesale (producer) level sits at a 7-year high of 3.4%. Current wholesale inflation levels reflect the broadening of inflationary pressures in the US economy. However, if the more volatile food and energy components are removed from this calculation, then the reading falls to 2.7%. This is still a little too high for the Fed’s comfort level. Wholesale inflation is an important economic variable because eventually inflation at the wholesale (producer) level tends to get passed along to consumers—causing a rise in the cost of living.

For those investors who dismiss inflation and are welcoming of a more accommodative Federal Reserve policy, they might be forgetting that rising costs will eventually eat into corporate profit margins. The only way to maintain profit margins would be to raise prices—making inflation run still higher. Thus, the Fed is trying to lean into the inflationary headwinds to try to slow them down now—before they get out of hand. In short, costs are rising and businesses that can pass on their costs to consumers will do so rather than seeing their profits fall.

Emerging Markets Feeling the Effects

Last year saw the emerging markets equities outperform the developed world’s equity markets for one of the few times in the last decade. Many thought that this was finally going to launch a lasting emerging markets bull market. However, this was not to be as these markets—along with most of the non-US markets around the world—began to decline or stay range bound.

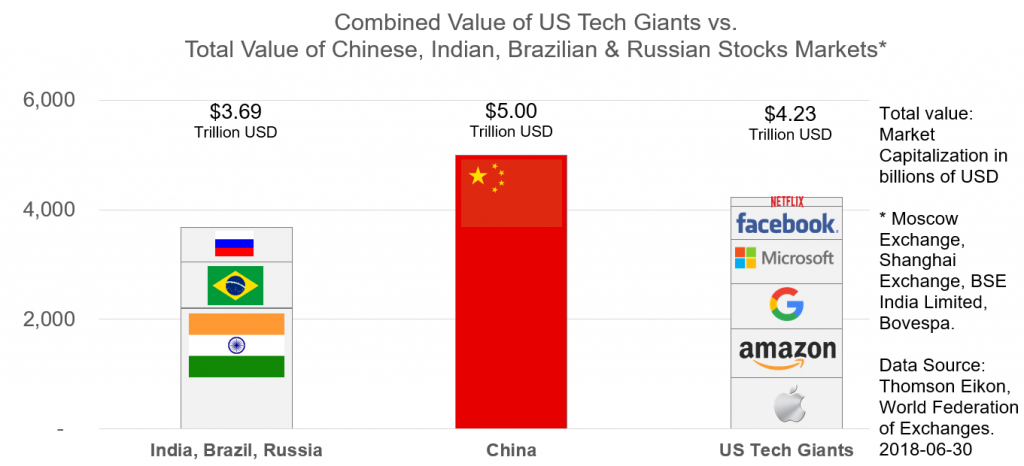

The optimistic case for emerging markets is grounded in their lower valuation when compared to the US equity market despite having faster growing economies and younger populations. Even with these impressive tailwinds, the emerging markets index as measured by the MSCI Emerging Markets Index has yielded a negative rate of return in 5 of the last 8 years—including 2018 year to date. For an additional perspective, as Figure 1 below shows, just six of the most popular US technology companies have a combined market value of about $4.2 trillion USD which is about 84% of the entire market value of all of the stocks on China’s Shanghai Stock Exchange.

Figure 1: Combined Value of US Tech Giants Vs. Total Value of Chinese, Indian, Brazilian & Russian Stock Markets

Data Source: Thomson Eikon & World Federation of Exchanges. June 30, 2018.

Emerging Markets Still Not Able to Overcome US Interest Rate Pressures

Traditionally, whenever the US raised interest rates, the economies of the emerging markets nations would decline steeply. The usual reason for the decline was due to the fact that foreign investment into these nations would dry up as investors sold their emerging markets holdings and moved the capital back to the US. The emerging market countries would then in turn suffer sharp currency depreciations as the capital inflows would dry up to a trickle, relatively speaking. Usually the fix for such a problem was to raise interest rates sharply to stem the currency outflows and stabilize the economy. This was a painful solution as higher interest rates would tend to hurt the economy at a time when it could use an interest rate cut for stimulus.

This time the markets believed that the emerging economies would be able to withstand the pressures from rising interest rates. Last year saw over $65 billion USD of net capital inflows to the emerging markets only to see a large reversal this year of that tidal wave of cash. This optimism was misplaced as old fears became new realities once again. For example, Argentina had to raise its interest rates to 40% this year and Turkey has seen its currency fall by 20% year to date. This has led to fears about which country could be next to feel the ill effects of a stronger US dollar.

Creation of New Alliances

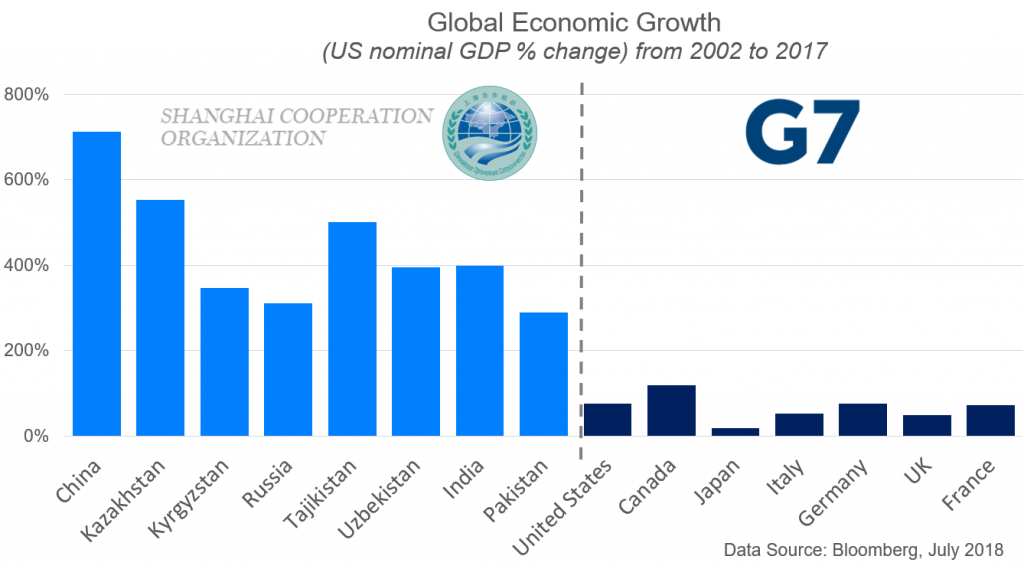

The US efforts to push back on trade and other matters have created new alliances between China and Europe and made alternative international organizations more important. For example, at the G7 meeting in Quebec last month, President Trump said he thinks Russia should be allowed back into the G7 club of nations. Many economists noted that given how slow the developed world’s economies are growing, perhaps Russia does not want back into the G7 (see Figure 2 below).

Figure 2: Global Economic Growth (US Nominal GDP% Change) from 2002 to 2017

Data Source: Bloomberg. July, 2018.

For its part, China has created an alternative international group called the Shanghai Cooperation Organization. These nations have economies of varying size but the growth rates have been rapid and sustained and represent 50% of the world’s population.

Despite all of these strengths, it seems the emerging markets are still at the mercy of the US Federal Reserve and investor sentiment towards wanting to own US technology stocks. Since 1976, there have been six emerging markets bull markets and on average, emerging markets equities have risen 230% over 42 months before they topped out. From our perspective, we still do not see a reversal in the emerging markets beginning to take shape but one that we are keeping a close watch for.

Taken as a whole, the US technology sector by itself has a market value that is almost three times that of the MSCI Emerging Markets Index. It is worth noting that technology stocks are a big part of the emerging markets index—as they are in the US. Technology stocks constitute almost 30% of the MSCI Emerging Markets Index.

Trade Disputes Dominating Investor Fears

As we began this newsletter, we talked about the ability of President Trump to dominate the market’s psyche. With the power of nothing more than a cell phone keyboard, he is able to set the markets rolling in one direction or the other. Perhaps most prominently since the start of his presidency, the Trump trade agenda has caused the most significant amount of investor angst. Thus far, the Trump Administration has launched six investigations into other countries’ trade practices, which have led the US to impose or announce tariffs on imports of more than 1,500 products (ranging from steel to household appliances that are valued at about $100 billion USD). In addition, investors fear pending investigations on autos and auto parts could lead to sanctions on another $300 billion USD. From our perspective, we think that many nations have engaged in some rough practices when it comes to trade and for the US, it looks as if things have finally come to a boiling point.

The trading partners of the US have started to push back and threaten sanctions on US exports of at least $200 billion. China has imposed tariffs of up to 25% on 128 different US products. For its part, the US has promised to up the ante and expand sanctions on another $200 billion in Chinese exports to the US while the European Union has imposed tariffs of 25% on US exports to Europe. The markets have now finally grasped the fact that Trump is serious on trade and is not likely to be satisfied with “a few crumbs” as China’s offer to buy up to another $70 billion in US exports was quickly rejected—partly for good reason. This is because much of this promise is related to products that China was already set to buy and the Chinese side was not willing to sign agreements to back this promise up.

Waning Corporate Confidence

The US willingness to engage in trade wars is based on the premise that since other countries rely on trade more than the US does, the US will be able to emerge victorious since it has the strongest ability to be the last one standing. According to the CATO Institute, the US economy depends less on trade than almost every other country (imports plus exports account for 27% of US gross domestic product compared to a world average of 53%). The damage to the US economy would still be considerable nonetheless in an all-out trade war involving escalating tariffs.

One small silver lining of the trade dispute anxiety is that many companies have ramped up production to get goods into international markets before the tariffs are expanded. This has provided a temporary lift to economic growth and this rush to produce and ship is why global shipments and manufacturing production have held up so far while business confidence has fallen. The most recent business confidence survey shows that businesses are looking at government policies with the highest negative opinion on record. As we mentioned, the euphoria and sugar high are fading quickly since the start of the year. Given that markets are forward looking, there is some potential for markets to price in lower future asset prices (valuations) should this trade-related friction continue for longer than expected.