The Limits of Economic Experimentation

Pacifica Partners Spring 2016 Quarterly Commentary:

This quarter’s newsletter gets its title from the growing global trend towards the acceptance of negative interest rates as a component of mainstream economic policy. Negative interest rate policy (NIRP) is increasingly being seen as an act of economic desperation by the markets. Currently, the central banks of Europe, Denmark, Sweden, Switzerland and Japan – representing over 25% of global GDP – have implemented negative interest rates.![]()

What is NIRP?

Simply described, NIRP is a policy in which a depositor is charged interest on their deposits – rather than receiving it. The central banks that have instituted negative interest rates are charging interest to commercial banks that deposit excess reserves with them. These excess reserves represent funds that the commercial banks’ customers have on deposit and that are in turn not being lent out due to either lack of loan demand or the commercial banks being too nervous to take the risk on making a loan. The goal of negative interest rate policy is to create a disincentive for the commercial banks to hold on to excess deposits so they will make loans more available to businesses and individuals. In turn, this borrowed capital will make its way through the economy.

Traditionally, banks earn interest income by lending out excess deposits and earn a spread (differential) between the interest rate paid to depositors and the rate charged to borrowers. With respect to commercial banks, NIRP makes it more expensive to sit on excess reserves and make lending money a more appealing option. The thought is that if banks will be penalized for not lending, they will make credit more accessible to help strengthen global economic growth.

Understanding the Weaknesses

There are two essential weaknesses that NIRP overlooks. What policy makers are not recognizing is that making something available does not mean it will be taken up. First, the demand for loans will depend on the opportunities available. For example, companies (borrowers) are not going to build a new factory or invest in new equipment if they are not confident about the future. After all, if a business is not willing to borrow at 2%, then the probability of being excited to borrow at 1% is not that great. On the flip side, banks (lenders) that are worried about borrower defaults on their loan books might find it more appealing to pay the negative interest rate on unlent reserves rather than take a chance on making a loan.

Secondly, bank profit margins globally are being squeezed due to low interest rates. In turn, they are finding ways to extract higher fees and reduce services to their customers to offset this. So it seems that in some respects NIRP is backfiring or having unintended consequences on consumers.

With respect to banks, the International Monetary Fund (IMF) has also indicated negative rates posed a “significant profitability challenge” for some commercial banks that could lead to “excessive risk taking”. In short, they believe that banks that are facing squeezed profitability from their lending operations could be tempted to extend loans into risky opportunities which they might not otherwise think about. The end result would be that the much needed structural changes that many companies and industries need to undertake would be avoided or delayed with the influx of cheap loans into corporate coffers.

Over-relying on Low Interest Rates

As we have maintained in past editions of our newsletters, ultra-low interest rate policies are causing distortions in the way the financial markets work and are causing investors to have to take on more risk (in return for higher income). With NIRP layered on top, the risk of distortion is even more significant.

We believe that low interest rates are not the solution to sustainably boost economic growth. Up to a point, they are helpful but if low interest rates were a solution to slow economic growth, they would have begun to have a greater effect by now. After all, it has been nearly a decade and the intended effects have yet to materialize.

In recent weeks, Warren Buffet, perhaps the most famous investor of all time, outlined the effects of NIRP on the operations of Berkshire Hathaway. Buffett said that “we are doing something the world has never seen. We do not know how this movie plays out. Berkshire Hathaway is sitting with billions of dollars of euros in an insurance company…in Europe and they will bear a negative rate. We would be better off with a big mattress in Europe that we just stick all this stuff in … It distorts everything.”

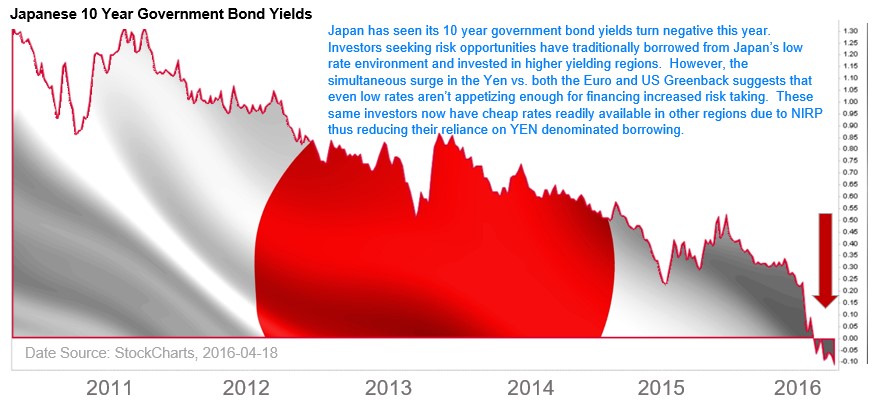

Critics of negative interest rate policy are pointing to Japan as proof that NIRP will not work over the longer term. In modern times, no major economy in history has ever undertaken the monetary experimentation that Japan has and the results have been mixed at best. After an initial surge, the last year has seen the Japanese economy reenter its long term funk as the familiar theme of low inflation, rising debt and slow economic growth has reasserted itself.

However, this is not isolated to Japan. The Bank for International Settlements (BIS) published a study that showed negative interest rates did not always encourage spending and borrowing. Some banks in Switzerland have begun to increase mortgage rates in order to mitigate costs incurred at the central bank. Switzerland’s experience points to a fundamental policy backfire if the intention of negative policy rates is to transmit reduced interest rates to the wider economy.

Savers are Penalized and the Borrowers are Rewarded

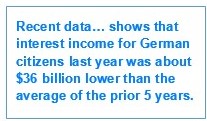

The critics of NIRP say that it does not come without side-effects. NIRP would only be beneficial for as long as the banks are able to pass on the full amount of the rate reduction to borrowers. When a central bank undertakes a policy of negative rates the goal is to have the borrowing rates grind lower to incentivize borrowing. The problem is that for savers, this  means they earn lower interest income on their savings. Recent data from the European Central Bank shows that interest income for German citizens last year was about $36 billion lower than the average of the prior 5 years. Another study released this year by a German investment firm estimates that German households will lose €224 billion in interest income over the next five years due to NIRP.

means they earn lower interest income on their savings. Recent data from the European Central Bank shows that interest income for German citizens last year was about $36 billion lower than the average of the prior 5 years. Another study released this year by a German investment firm estimates that German households will lose €224 billion in interest income over the next five years due to NIRP.

The NIRP skeptics also believe that savers could react by saving even more (spending less) due to the lack of income (interest) they receive on their deposits. Olaf Stotz, a professor of asset management at the Frankfurt School of Finance, was quoted in Handelsblatt, the German business newspaper, as saying that a 35-year-old German man on an average income with a life expectancy of 79 years would have had to put aside €168 a month in 2007 to maintain his standard of living in retirement. But by 2015, he would have needed to put aside more than twice as much – €360 per month. That is equivalent to an annual increase in costs of 13.5 percent since 2008.

While NIRP is hurting savers, countries with high levels of debt are an unambiguous winner. Economists estimate that Italy has saved nearly €60 billion in interest costs due to low interest rates over the last four years. Currently, over $7 trillion of government bonds worldwide are paying negative interest rates. That is to say that the investors who hold these bonds will not get their money back.

Cash Hoarding

One of the negative side effects of NIRP is cash hoarding. The IMF has said there is evidence that demand for big denomination banknotes had increased in Switzerland and Japan as citizens of these countries hoard cash at home rather than in the bank. The cash hoarding is a byproduct of negative interest rates since NIRP is a great disincentive for making or holding bank deposits. In countries with high value banknotes such as Switzerland, where denominations are as high as 1000 Swiss francs, individuals and corporations may be more inclined to hoard cash as the physical space needed to store large amounts away is smaller.

Lending further credence to the potential deflationary impact of NIRP is that the Japanese Finance Ministry has announced that it will print 1.23 billion ¥10,000 bills in fiscal year 2016, an increase of 180 million from a year earlier. Furthermore, the Bank of Japan’s NIRP policies are being blamed for the fact that the total amount of cash stashed in homes as opposed to the bank is estimated to have surged by nearly ¥5 trillion to ¥40 trillion in the past year.

Journey Into Uncharted Waters

NIRP has allowed Europe and Japan to finance massive debt loads by borrowing for less than nothing. As the chart above shows, the yield on Japanese 10-year government bonds is now below zero. The buyers of these countries’ bonds are willingly losing money by being paid back less than they initially invested. If individuals react to this interest rate backdrop by determining that in order to offset forgone interest income in the era of low interest rates that they have to save more, then NIRP will have had a serious unintended consequence. In turn, if banks decide that they have to maintain their profitability in a low interest rate world by cutting loans and raising fees, once again NIRP will be something that was not intentioned. Lastly, if corporations and individuals do not react to low interest rates by increasing their borrowing because of a lack of confidence, then once again, NIRP will have caused more harm than good.

A Bandaid Solution

NIRP is unable to address some of the real factors that are subduing economic growth such as ageing populations, high debt levels, low productivity and overinvestment in too many industries. The answer to these challenges is not lower interest rates.

NIRP might force some consumers who are saving for retirement to reduce spending if they are going to reach their retirement income goals and retirees with lower incomes might decide to react by cutting consumption as well. A monetary policy intended to spark growth, then, in fact, risks reducing consumer spending.

In recent weeks, some have put forward the notion that the US could bring in a NIRP. At this point, that would seem a gross overreaction given that the US labor market is the strongest it has been in a long time with unemployment sitting at 5% and wages showing some signs of strengthening on a continued basis.

That being said, the interest rate futures markets are pricing in a low probability of more than one US interest rate increase in 2016. Part of this is based on the fact that the global economy continues to show weakness and only tentative signs of strength. Officially, the Federal Reserve is only supposed to focus on the domestic US economy. But recognizing that the world is increasingly interconnected, San Francisco Federal Reserve President John Williams said that “we have a domestic mandate…but that said, we understand that we’re in a global economy so what happens in Brazil or China has a huge impact on the US in terms of our inflation and employment goals”.

While the US is far from likely to implement a NIRP policy, it is taking notice of the difficulties seen around the world. However, if the labor market data and steadying of US inflation continues, it will not be long before the bond markets begin to ratchet up US interest rates. The implications for the international markets would be substantial as it would create a gulf between US interest rates and those around the world.

The information in this newsletter is current as at April 15, 2016, and does not necessarily reflect subsequent market events and conditions.

This newsletter is published for information purposes only and articles do not provide individual financial, legal, tax or investment advice. Past performance is not indicative of future performance.

Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance. The statements and statistics contained herein are based on material believed to be reliable, but are not guaranteed to be accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual’s objectives in consultation with their legal, investment and/or tax advisor. Pacifica Partners Inc. and Pacifica Partners Capital Management Inc. are not liable for any errors or omissions in the information or for any loss or damage suffered.

Pacifica Partners Inc., Pacifica Partners Capital Management Inc. and/or their officers, directors, or representatives may hold some of the securities mentioned herein and may from time to time purchase and/or sell same on the stock market or otherwise.

No part of this publication may be reproduced without the expressed written consent of Pacifica Partners Inc.

Pacifica Partners Inc. is a Canadian incorporated entity and is a registered Portfolio Manager in certain Canadian Provinces.

Pacifica Partners Capital Management Inc. is a US incorporated entity, wholly owned by Pacifica Partners Inc., and a Registered Investment Advisor with the SEC.

© 2016 Pacifica Partners Inc. All rights reserved.