The Crude Reality of OPEC’S Cartel

A little over a decade ago, some investors began to question the relevance of the US Federal Reserve. Given the reputation that the US central bank had carved out for itself since the 1980s, this was a stunning turn of events for many. Eventually, the Federal Reserve took notice of this and was forced to make public pronouncements of its relevancy. This question was emphatically answered with a “Yes!” when the Fed was looked upon to save the global financial system.

Similarly, many are now asking if OPEC, or more formally the Organization of Petroleum Exporting Countries, is relevant. This is despite the fact that it controls over 60% of the world’s oil exports and holds 80% of the world’s proven oil reserves. This too would have been considered a laughable question – even a few short years ago. The reason for this question comes from the fact that many are looking at the fact that OPEC’s most powerful member – Saudi Arabia – has seemingly lost its ability to control the oil markets.

Since its founding in 1960, OPEC could show its influence by even a simple announcement which had the power to send economies to recession or breathe a sigh of relief. OPEC’s power was at its peak in the 1970s when it decided to put the US on an oil embargo which led to a recession and inflation to break out at the same time. Unlike today, US oil production had hit the wall back then and the US energy industry was unable to bring on new supplies—and OPEC knew it.

Today, that influence is being challenged by the rise of oil supplies from non-OPEC nations. While Russia, Norway, and Canada have always been key non-OPEC oil producers, it is the rise of US oil production that has proven to be the greatest challenge to OPEC.

The Texas Challenge

The rise in US production has been led by the production from the Permian Basin in Texas – a 75000 square mile area extending from western Texas to southeastern New Mexico. Since 1920, the Permian has produced a total of 30 billion barrels of oil and 75 trillion cubic feet of natural gas. The Permian produces 2 million barrels/day currently and some industry experts predict it will be up 10 million barrels/day within the next decade. The Permian currently ranks as the second largest oil field in the world after Saudi Arabia’s Ghawar field which produces a little over 5 million barrels per day.

This frames the question about OPEC’s relevance neatly. Nearly three years ago, Saudi Arabia reacted to rapidly falling oil prices in an unexpected manner. Rather than leading OPEC on an oil production cut policy aimed at lifting oil prices, the Saudis told the world that they would no longer try to support oil prices. Instead they would choose to secure their market share of the global oil market. While that was the official OPEC declaration, the Saudis had a much larger strategic (long term) aim.

It is generally assumed that the policy was put into motion to cut short the renaissance in US oil production. The theory behind this was that the Saudis would use their lower production cost advantage to force oil prices to levels where the more cost heavy US energy industry could not compete at. In short, they were going to drive up the oil supply to lower oil prices to levels that would force US oil companies out of business.

Saudi Arabia, Rock, Hard place

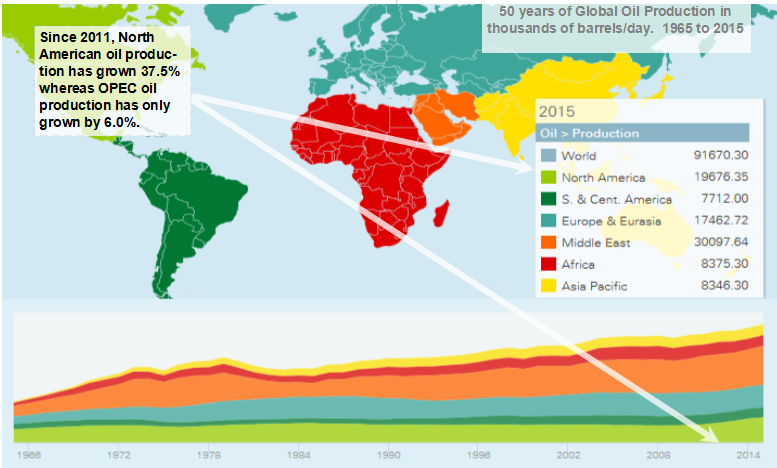

From our perspective, Saudi Arabia & OPEC faced a Hobson’s Choice in deciding how to respond to the freefall in oil prices that began in 2014 (i.e. Having to choose between the necessity of accepting one of two or more equally objectionable alternatives). For OPEC, it meant it could cut production to stop the price of oil from falling (i.e. reduce supply) but that would not stop the competitive threat from the rise in US oil production since US producers would use stronger oil prices to keep raising production to offset the supply cut from OPEC. As depicted in Figure 1, the the North American oil production has grown immensely since 2011 compared to OPEC’s oil production. The second alternative was to take on non-OPEC oil producers by not cutting production to force them out of business. Either one of these would hurt the Saudis and OPEC since most of the OPEC nations were facing huge spending requirements to keep their young and rising populations happy. For Saudi Arabia, its population has risen by 50% since 2000.

Figure 1: Global Oil Production in Thousands of Barrels/Day from 1965 to 2015

Data Source: BP PLC., April 12, 2017

When the Saudis convinced OPEC to abandon an attempt to keep oil prices at elevated levels in order to protect market share and hurt non-OPEC producers, it was by no means the first time that Saudi Arabia has tried this. But the result was different this time because once the dust settled – Saudi Arabia came to be seen as a weakened power within OPEC. The end result of its policies has been to all but publicly admit that OPEC failed in its attempt to impose its will upon the oil markets.

Instead, it has gone back to Plan A to limit supplies of oil. In late 2016, OPEC members agreed to cut production by 1.2 million barrels per day which is a 3.7% cut in production. This is slightly above the average 2015 production level. Further underlining how much things have changed—Saudi Arabia agreed to absorb most of the production cuts. This is interesting because when it pushed for a market share focused policy it said that it was tired of having to do the heaviest lifting when it came to production cuts while other OPEC members enjoyed the benefits. This was a Saudi reversal to be sure.

OPEC’s Miscalculation

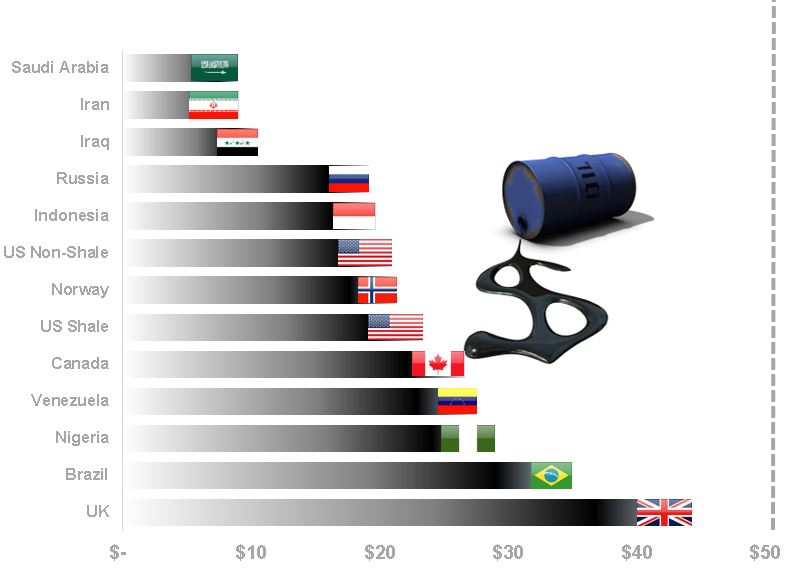

It seems that OPEC made some miscalculations when it embarked on its policy at trying to get control back over the oil markets. First, while US production has come down from its peak, it proved to be resilient in the face of lower oil prices as American companies became more efficient due to technological advancements which allowed them to lower their costs. It used to be thought a few short years ago that the US shale industry needed oil prices to stay at about $50/barrel to break-even. As seen in Figure 2 below, today the break-even levels are lower as the average cost of production for the US shale industry hovers at around $20/barrel. Even some offshore oil fields have seen a dramatic reduction in costs to the point that Shell recently said it has brought the break even costs down to $42/barrel for some of their offshore fields—a reduction of over 30% from the levels of 2013-2014.

Figure 2: Average Cash Cost to Produce a Barrel of Oil or Gas Equivalent in 2016 ($USD)

Source: The Wall Street Journal, March 31, 2017

Another reason that US oil production did not collapse was because smaller to mid-sized producers had to keep producing oil to pay back some of the enormous capital that had been borrowed during the previous boom. Essentially, they had to keep producing oil at little to no profit so they could keep paying off their debts. This allowed the US oil industry to “stay in the ring” longer than expected—something Saudi Arabia, OPEC & the oil markets had not anticipated.

Lastly, Saudi Arabia simply ran out of time. They could not sustain the pressures that low oil prices were exerting on its finances. It was seeing a rapid decline in its accumulated reserves due to rising budget deficits since its budget depends on oil for over 80% of its revenues. Thus, they needed to figure out a new way to get the price of oil up—and fast!

In addition to its other challenges is a civil war on its doorstep in neighboring Yemen where Saudi Arabia is spending vast sums to counter Iranian influence (not to mention Syria where it is trying to overthrow the current regime). It is worth noting that the official budget figures show that the military makes up 25% of the Saudi budget – though unofficially it is likely significantly higher and rising. Saudi Arabia has recently surpassed Russia to become the third largest spender on defense in the world.

Recognizing that perhaps its reign above the global oil markets is past its zenith, the Saudis have unveiled their Vision 2030 initiative in which they look to reduce the country’s reliance on oil. The policy is aimed at developing more private business, enhancing education and reducing the drain on the nation’s financial reserves by cutting subsidies, bonuses for government employees and implementing a 5% value-added tax on the sale of goods and services.

Saudi Arabia Divesting from Oil

The most significant plank of the Vision 2030 plan is that Saudi Arabia has announced plans to sell a 5% share in Aramco – its national oil company. The Saudis nationalized Aramco in 1980 as the government looked to put a stranglehold on global oil markets as it calculated at the time that there were no other great alternatives to OPEC. For the share sale to be a success and to earn a maximum rate of return, the Saudis are trying to lift oil prices to get a premium price for the Aramco share sale. This shows that the Saudi time horizon is likely focused on the short term – and not the long-term fundamentals of the oil markets.

While markets are currently being supplied comfortably with enough oil to meet world demand, there is a geopolitical risk to oil supplies should conflict in the Middle East escalate or if a key member of OPEC is destabilized. The most key member is Saudi Arabia and if it were to be destabilized, the shockwaves through the oil markets and the global economy would be significant.

The other area of instability that could rock oil markets is a restriction on the supply routes that tankers use to move oil from one nation to another. To put this in context, the Persian Gulf supplies 30% of the global supply of oil and East Asia consumes 85% of this oil.

Where Saudi Arabia was at one time the only oil producer to watch – now the US has emerged as “the other swing producer”. If Saudi Arabia and OPEC take any measures aimed at lifting oil prices then US oil production will be able to rapidly step up and take advantage of this. If oil prices remain lower for longer, then the OPEC nations over which Saudi Arabia holds leadership will suffer from extreme financial challenges – given their overwhelming reliance on oil revenues. For Saudi Arabia, about 80% of its revenues come from energy. The Saudis are already bearing the brunt of the production cuts and are turning a blind eye towards OPEC members who are producing above their official quota.

The Venezuelan Reminder

The experience of Venezuela provides an example of what could happen. In recent months, Venezuela’s economy has come to a standstill and riots have sprung up across the country in response to shortages of basic goods and food. At the same time, its oil production has fallen from about 2.4 million barrels per day to an estimated 1.9 million barrels per day over the last year with an expectation of a steeper drop later this year. In addition, its state-owned oil company is close to default on its debt.

If a “Venezuela scenario” were to unfold in a major OPEC member such as Saudi Arabia, OPEC’s relevance would certainly be felt – but not in the way the world is used to. OPEC is still a formidable force due to its immense oil reserves and the geopolitics of the Middle East. But its ability to set the course for oil prices is greatly diminished. As the world adopts other technologies for its energy needs, other nations might want to look at the Saudi Vision 2030 plan as a model for their future. For now it seems that OPEC’s future influence on oil is likely to stem more from worries about stability amongst its members rather than their ability to exert control of oil prices the way they once did.