Testing Trumponomics Against the Realities of the Federal Reserve

As we have commented in prior first quarter commentaries, we are somewhat puzzled at the amount of energy Wall Street and the financial media expend into making annual predictions each January. This time is no different. Seldom do the predictions pan out and most major political, economic and geopolitical events that transpire are seldom foreseen. Thinking back to 2016 some examples of significant unforeseen events include Brexit and the resignation of the British Prime Minister, Donald Trump becoming President, and Europe continually defying skeptics and managing to hold together. Simply put, there are too many unknowns and too many variables that tend to come together in unexpected ways.

Rather than join the fray and attempt to take a poke at coming up with an exact number for where the markets will finish in 2017, we thought it would be better to focus on the one thing that is at the forefront of the global markets’ collective mindset: US economic policies under Donald Trump.

Rates & Valuations

Without doubt, interest rates are one of the key variables in finance. The talk of deflation and disinflation has been largely stamped out over the last year. Instead, the focus of the markets has switched to whether or not interest rates have finally seen their low. Investors have been asking this question for over 35 years when interest rates peaked in the early 1980s and homeowners were paying double digit interest rates on their mortgages.

We believe that if interest rates have seen their bottom then their path higher will be a long and grinding climb. In other words, it will take time for interest rates to reach a pain threshold for the financial markets and the broader economy.

That being said, if interest rates are working their way higher and the market begins to get comfortable with such a notion, then bonds will begin to offer an increasingly attractive alternative to investors. This is because investors will look at the new (higher) interest rates and perceive them to offer a safer income stream than a dividend paying equity. This could begin to create some stiff competition for investor attention.

In the worst case scenario for stocks where higher interest rates were to return and stick, stocks would have to be repriced lower – all else being equal. One way stocks would get repriced lower is by investors becoming less willing to pay the premium valuation they would otherwise pay in a world in which the alternative facing investors is rock bottom interest rate earnings (yields). One way to measure this premium is the price – to – earnings ratio (P/E Ratio) – which is the price investors are willing to pay for each dollar of earnings that companies earn.

The Only Game in Town

For the better part of a decade, US equities have been one of the few games in town for global investors. US equities have led global markets as a whole despite the fact that US equities have been priced at a premium to international equities (i.e. International markets are cheaper than the S&P 500 by a fair margin).

Markets have quickly priced into stock prices the possibility that the incoming Trump administration will put forward a trillion dollar stimulus program consisting of tax cuts and spending. Investors have become comfortable with the idea that this spending program and a tax reform package would combine to boost the US economic growth rate from the 2% range to over 3% per year. This would also be a boost to the global economy since the US economy is the largest by far. As Trump mentioned in his victory speech following last November’s election, “We are going to fix our inner cities, and rebuild our highways, bridges, tunnels, airports, schools, hospitals…We’re going to rebuild our infrastructure, which will become, by the way, second to none. And we will put millions of our people to work as we rebuild it.”

Timing of Stimulus Not Ideal

Therein lies the potential problem. Historically, the time for such a large fiscal stimulus program tends to be when the economy is trying to escape the clutches of a recession. The current economic recovery is over 8 years old and US unemployment is at a nine year low of 4.6%. In fact, many businesses are showing signs of stress from having to compete for workers or raise their wages to keep them from jumping ship. Adding on a multi-trillion spending program can only enhance the upward pressure on wages and in turn fuel inflation as consumer spending and income rise together. At this point, it is more than likely that a stimulus program of that size could be detrimental to the economy – though there is a need for infrastructure improvements. The question is one of timing and scale in that doing so now in a large scale fashion might upset the slow but steady economic expansion by overheating the economy too soon.

The Missing Stimulus Discussion

During the past election cycle, the level of debate about the economy from all sides and candidates was not particularly illuminating of the challenges facing economic growth. It is not simply a matter of more stimulus through spending and tax cuts. There is the challenge of the national debt which we outlined in last Fall’s newsletter. But even more so, there is the problem that most of the industrialized world faces – that is one of demographics. Simply put, there is an insufficient supply of labor (workers) due to some workers leaving the workforce because of a skills shortfall or choosing to retire. In addition, most industrialized nations are facing ageing societies and the challenges that brings.

The US economy – like others around the world – needs workers to work longer before choosing retirement and for an increase in the supply of younger workers. Should this happen, there would be enough workers to accommodate the demand for labor that a stimulus program would bring about. That would certainly allow the stimulus program to boost the economy on a more sustained basis.

A further danger to the benefit of a stimulus program is that the US economy – among so many others – has been showing multi-decade lows in productivity growth. As we noted in our Summer 2015 newsletter, productivity is a key determinant of a nation’s ability to grow incomes and the economic growth rate. Economists cannot agree on the causes of this downturn – let alone solutions. But one thing they can agree on is that it is a challenge. The stimulus program that is announced should try to focus on overcoming the productivity challenge but it will be difficult to achieve.

Without an upturn in productivity, the chances of inflation coming back increase and we reiterate again, an ill timed stimulus program could make matters worse by raising inflationary pressures and in turn interest rates. A rise in interest rates would essentially weaken the effect on economic growth that the stimulus program is aimed at achieving.

For its part, the US Federal Reserve has signalled that it is increasingly comfortable with lifting interest rates in light of the fact that the unemployment rate is below 5% and labor markets are tight. Clearly, the central bankers in the US recognize that they run the risk of falling behind the interest rate curve if they allow labor markets to continue to tighten up much further. For 2017, the betting at this point leans towards two or three interest rate increases this year of 0.25% each – leaving them still quite low by historical standards.

How to Pay For It All

The last item with respect to stimulus relates to how to pay for it. As we noted in our Fall 2016 newsletter, the national debt of the US will be a challenge to whoever was going to win the election. The Trump administration seems to be up front in its willingness to raise the national debt. As Trump campaign chairman Steve Bannon said after the election, “It’s everything related to jobs. The conservatives are going to go crazy. I’m the guy pushing a trillion-dollar infrastructure plan. With negative interest rates throughout the world, it’s the greatest opportunity to rebuild everything.” Clearly Bannon’s view of interest rates differs from that of the Federal Reserve.

There is likely to be some pushback from the Republican majority in Congress. Many of the most influential members have said that they are in the dark on the details and are averse to piling on huge sums to the national debt. As Senate Majority Leader Mitch McConnell stated to reporters in the aftermath of the election, “What I hope we will clearly avoid, and I’m confident we will, is a trillion-dollar stimulus …we need to do this carefully and correctly and the issue of how to pay for it needs to be dealt with responsibly.”

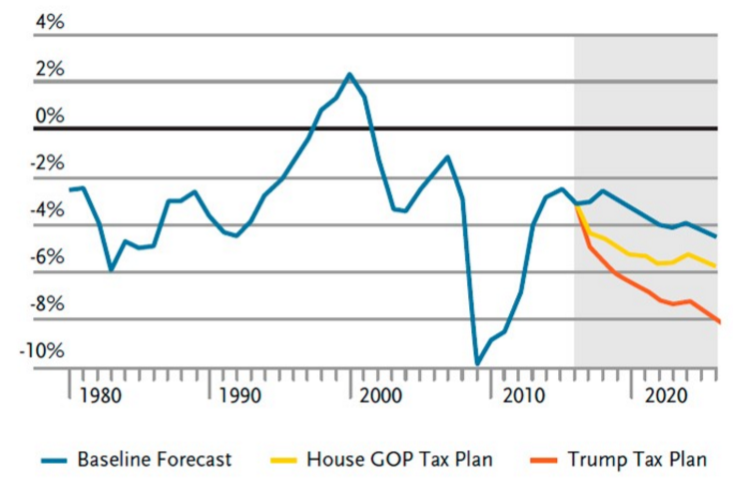

Clearly, the White House and Congress will have much to talk about. As Figure 1 below shows, the Congressional Budget Office projects the Trump plan will nearly double the annual budget deficit from the current baseline projections.

Figure 1: Total US Federal trade surplus and deficits, as a percentage of GDP

Sources: CBO, Tax Policy Center, Cornerstone Macro

As we have noted above, interest rate increases are likely this year. Given the huge debt load of the US, it is estimated that every 0.25% increase in interest rates raises debt servicing costs by $50 billion annually. This would certainly crimp the government’s capacity for stimulus.

The Global Backdrop

Many nations have been getting nervous on the international trade front. Donald Trump has made no secret of the fact that he will hold “accountable” those nations that he deems to be engaging in unfair trade. Trump spokesman Sean Spicer told reporters recently “When a company that’s in the U.S. moves to another place, whether it’s Canada or Mexico, or any other country seeking to put U.S. workers at a disadvantage, then Donald Trump is going to do everything he can to deter that.”

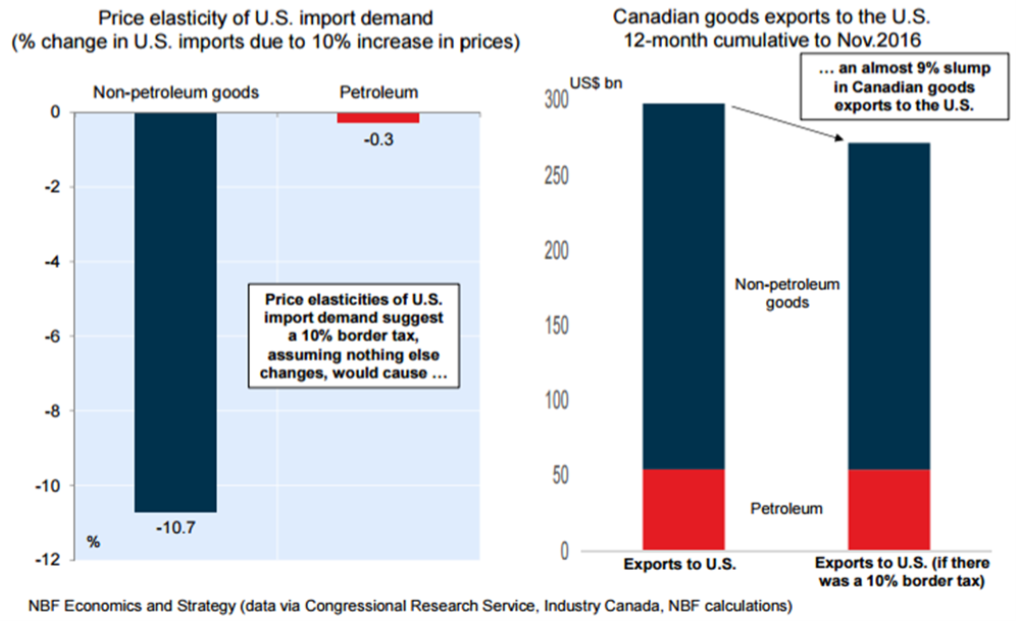

Specifically, he has leaned on the auto sector to reduce investment in Mexico and pointed at China, Japan and most recently – Europe. Even Canada has not been spared as some on the Trump transition team have said that Canadian auto exports could see a tax of 10% at the US border. If this were to be the case, then that would leave the North American Free Trade Agreement (NAFTA) in tatters and the Canadian economy wounded – potentially severely as the chart below shows.

As of 2015, the largest market for US exports is Canada. Trade barriers that hurt the Canadian economy would in turn hurt US economic growth since nearly 20% of all US exports go to Canada. As the Figure 2 below shows, a 10% tax by the US on imports from Canada would drop Canadian exports by about 9% – which is nearly $28 billion of exports.

Figure 2: Impact of the proposed Border Tax Adjustment on Canada

Taking a Cautious Approach

While equity valuations are on the high side, we are still able to find pockets of fairly valued equities. The rise in interest rates has made bonds relatively more attractive than they have been in quite some time. We are cautious on the linear logic that markets have employed around the stimulus program and its ability to raise economic growth. If enacted in its entirety, the Trump proposals on tax cuts and spending would raise economic growth but at the risk of an explosion in debt and higher interest rates. Clearly, the US Federal Reserve is worried about this possibility and has signalled a willingness to enact tighter monetary policies in response. For its part, Congress has also given a lukewarm reception for stimulus and tax cuts that are not at least in part paid for up front. Taking all of these factors together, we could see markets having to revisit their most optimistic assumptions.